Become a Student Member

Membership for accounting students is free and will be valid for one year from your graduation date.

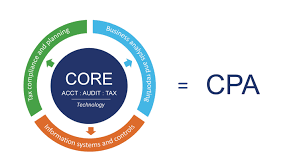

The Florida Institute of CPAs is the largest, most influential association of accounting and finance professionals in Florida, dedicated to supporting one another and promoting and protecting the value of the CPA designation.

With 23 local chapters and more than 18,500 members, we are committed to promoting excellence in the accounting professions. It all starts here...helping qualified students become part of this dynamic and rewarding profession.

Membership Benefits

- A community of 18,500 across the state

- Membership in one of 23 local chapters with access to local networking events and service opportunities

- Scholarship opportunities with the FICPA Scholarship Foundation

- Leadership training opportunities

- Discounts on CPA Exam prep courses

- List FICPA on your resume to show future employers your commitment to the profession

- Access to coaching and advice on resumes, internships, and career paths

- Exclusive student member communications keeping you up to date on professional issues

Thank you to Gleim and WatsonRice for sponsoring our following student programs and resources:

Student Ambassador - Lead On Your Campus

The FICPA Student Ambassador Program operates at 32 Florida universities and colleges. Ambassadors are accounting students who volunteer to be the "face" of the FICPA on their campus and provide students with a better understanding of the rewarding career and opportunities that come with an accounting degree and the benefits of becoming a CPA. Serving in this roll allows you to expand your peer-to-peer networking, interact with faculty and meet CPA members of the FICPA.

CPA Exam Resources - Preparing for the CPA Exam

We'll be with you every step of the way with discounts on CPA Exam review courses, helping make sure you've fulfilled the requirements, and on-on-one guidance to help navigate the certification process.

Accounting Scholars Leadership Symposium - Benefits Of Earning The CPA Credential

The Accounting Scholars Leadership Symposium is a two-day, invitation-only exciting professional development opportunity held in conjunction with the FICPA Mega Conference designed to help accounting students from all backgrounds prepare for a successful future in the accounting industry. Participants will hear from leaders in the profession as they highlight the limitless possibilities of a career as a CPA.

Career Opportunities - Propel Your Career

Looking for an internship, or need help with your resume or social profile? Visit the FICPA Career Center for those answers and more resources to help you ace that next interview.

FICPA Scholarship Foundation Supports Future CPAs

Scholarships recognize accounting students and CPA candidates who demonstrate strong academic performance, leadership qualities, and financial need. Annually the Foundation awards over 70 scholarships to the most diverse and deserving accounting students across the state. Scholarships are awarded to 4th and 5th year accounting students. Applications will be open in January.

CPA Exam Upcoming Changes

In 2024, the AICPA and NASBA will launch an infrastructure change to the CPA Exam.

Going For Your CPA

FICPA knows navigating the path to become a CPA isn't easy, and we want you to have all the information you need to make the best decision about your career. Taking and passing the CPA Exam requires time, effort, and dedication.

Need more direction or have a question regarding your academics or how to sit for the CPA exam, email emergpro@ficpa.org.

We're here to help!