Legislative Update

Advocacy Update: 2022 Primary Election Recap

Florida's primary season reached its end this week, meaning the push is on to the state's General Election on Nov. 8.

In this Aug. 26 edition of Advocacy Update, we address:

- Our CPA/PAC's primary season success

- The FICPA's General Election webinar on Oct. 5

- Florida's new condominium reform legislation

- Congress' recent letter to the IRS

- Auditor General's review of school board audit reports

- And more!

Advocacy in Action

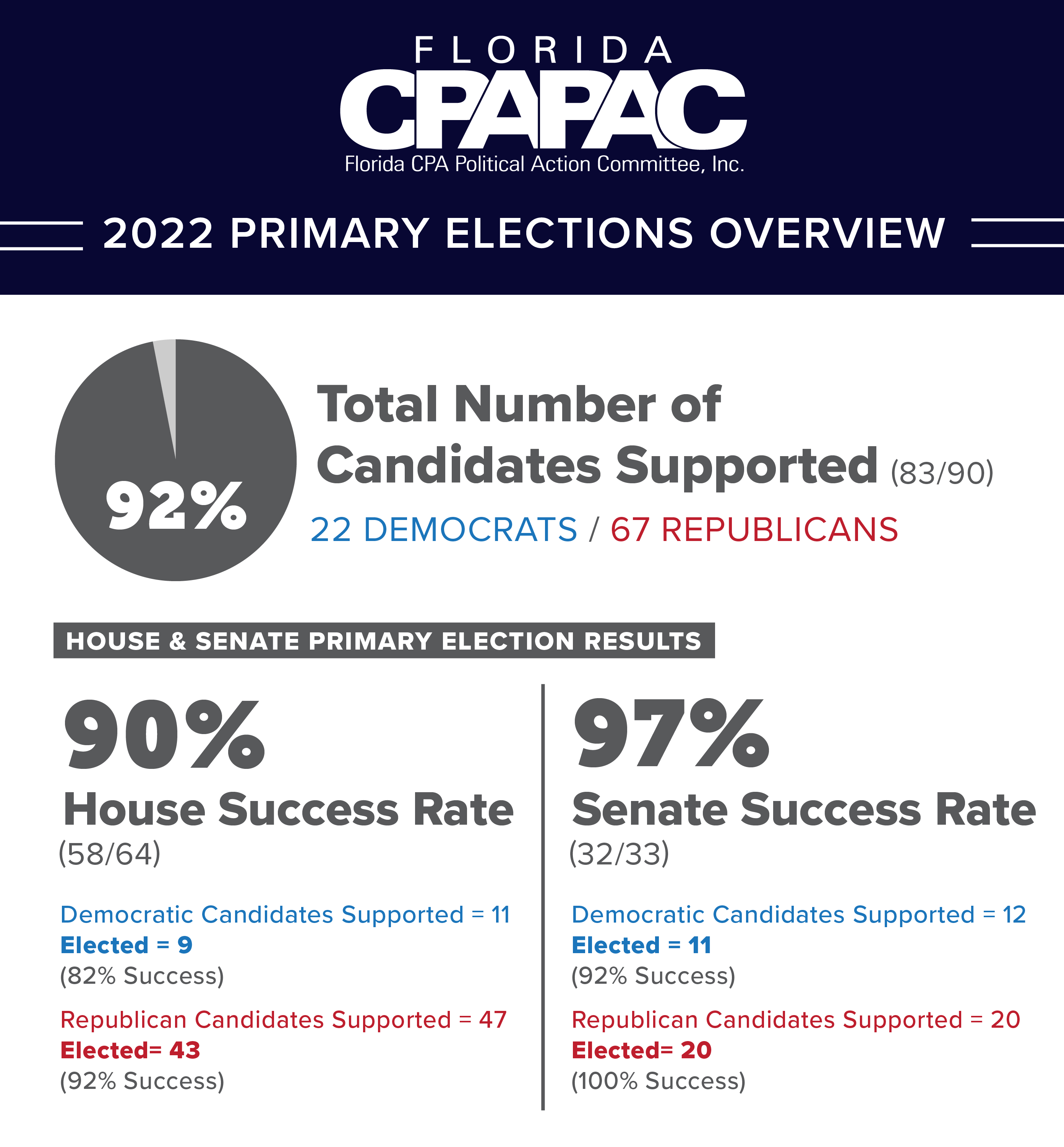

Florida CPA/PAC Candidates Win in Florida’s Primary Election

Florida’s Primary Election was held Tuesday and 92 percent of Florida CPA/PAC-supported candidates were victorious in their races!

Here’s a breakdown of our PAC-supported candidates’ success.

PAC-supported candidates undergo a rigorous vetting process that includes candidate interviews by our FICPA Governmental Affairs Team. Through those interviews, we evaluate hundreds of candidates statewide on a comprehensive set of factors, including responses to the Florida CPA/PAC’s Candidate Questionnaire.

Participating in candidate interviews, receiving member recommendations and thoroughly researching candidates helps ensure the Florida CPA/PAC supports candidates who, once elected, will prioritize the interests of Florida CPAs and the future of the profession.

On an ongoing basis, we encourage FICPA members to submit recommendations for candidates running for state office in their local areas. Please send recommendations to [email protected].

Save the Date! Florida General Election Webinar

On Oct. 5, the FICPA will present a webinar highlighting candidates and issues relative to the Nov. 8 General Election.

During this exclusive, members-only webinar, FICPA Chief External Affairs Officer Justin Thames and Liberty Partners of Tallahassee President Jennifer Green will provide a briefing on the upcoming election.

The webinar will include information about candidates the FICPA and the Florida CPA/PAC are supporting during this election cycle.

Please mark your calendar and plan to join us for this informative, interactive discussion.

FICPA Delivers Contributions Ahead of Primary Elections

Along with our Key Person Contacts, the FICPA Advocacy Team busily delivered over 50 campaign contribution checks ahead of the Aug. 23 Primary Election.

FICPA President & CEO Shelly Weir and Chief External Affairs Officer Justin Thames deliver a check to House District 15 Candidate Dean Black

Chris McDermit, CPA, delivers a check to Rep. Kristen Arrington

Legislation Amends Condos and Cooperatives Building Reporting

Sweeping changes to Florida’s Condominium Act were made during the Florida Legislature’s Special Session to address concerns raised in the aftermath of the Surfside condominium collapse. All condominium and cooperative associations with buildings three stories or higher are required to report certain information to the Division of Florida Condominium, Timeshares and Mobile Homes on or before Jan. 1, 2023.

Associations can report online or learn more information about the new requirements here.

In case you missed it, you can read the most recent article in Florida CPA Today for valuable insight on this topic from the FICPA CIRA Committee.

Checking in With Our CPA Lawmakers

FICPA Chief External Affairs Officer Justin Thames presents Rep. Mike Caruso with a plaque commemorating his service to the FICPA and the CPA profession. The plaque features the Spring 2022 issue of Florida CPA Today, highlighting the 2022 Legislative Session.

Sen. Joe Gruters enlists campaign help from his family in advance of the Aug. 23 Primary Election.

Latest News

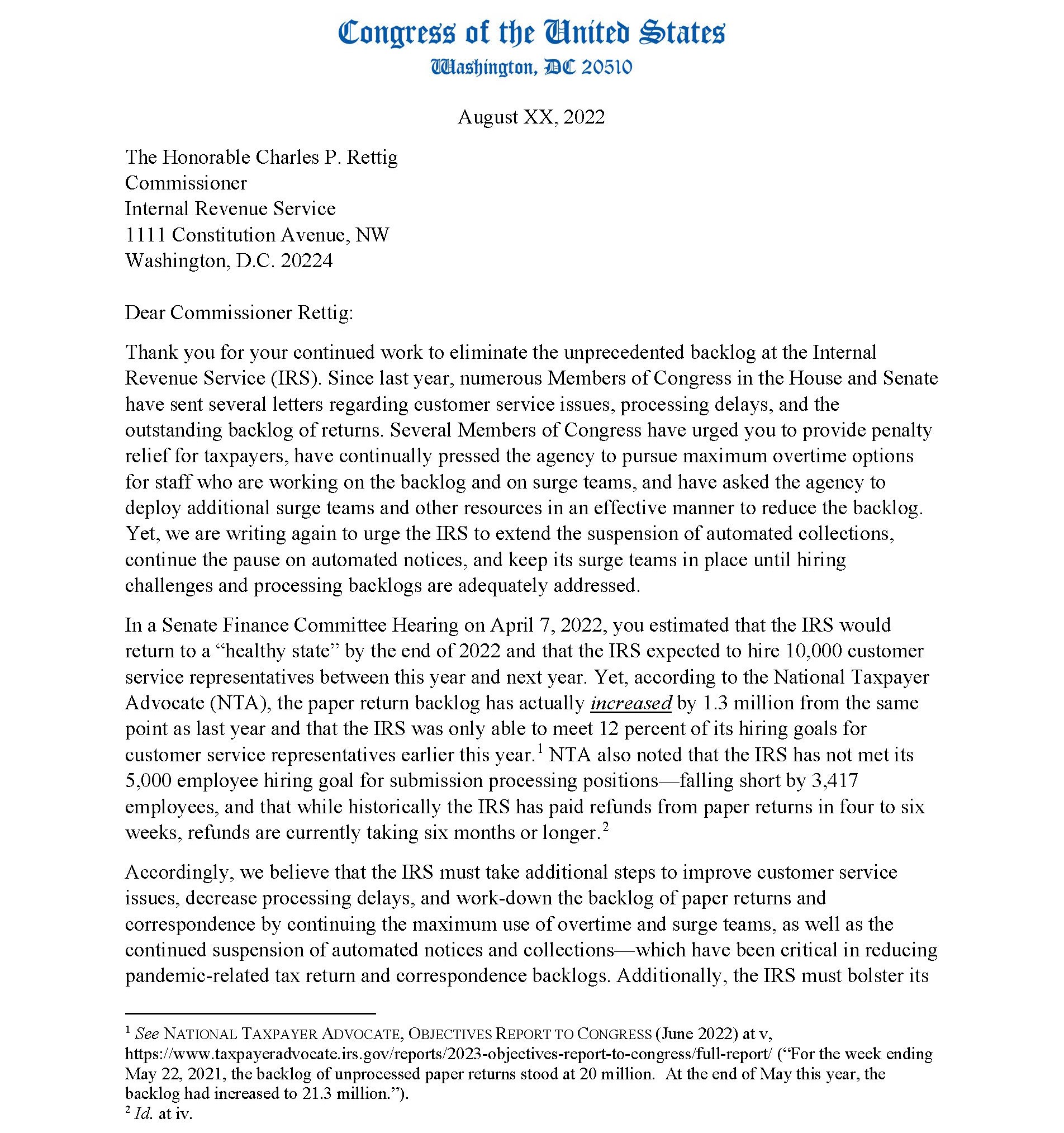

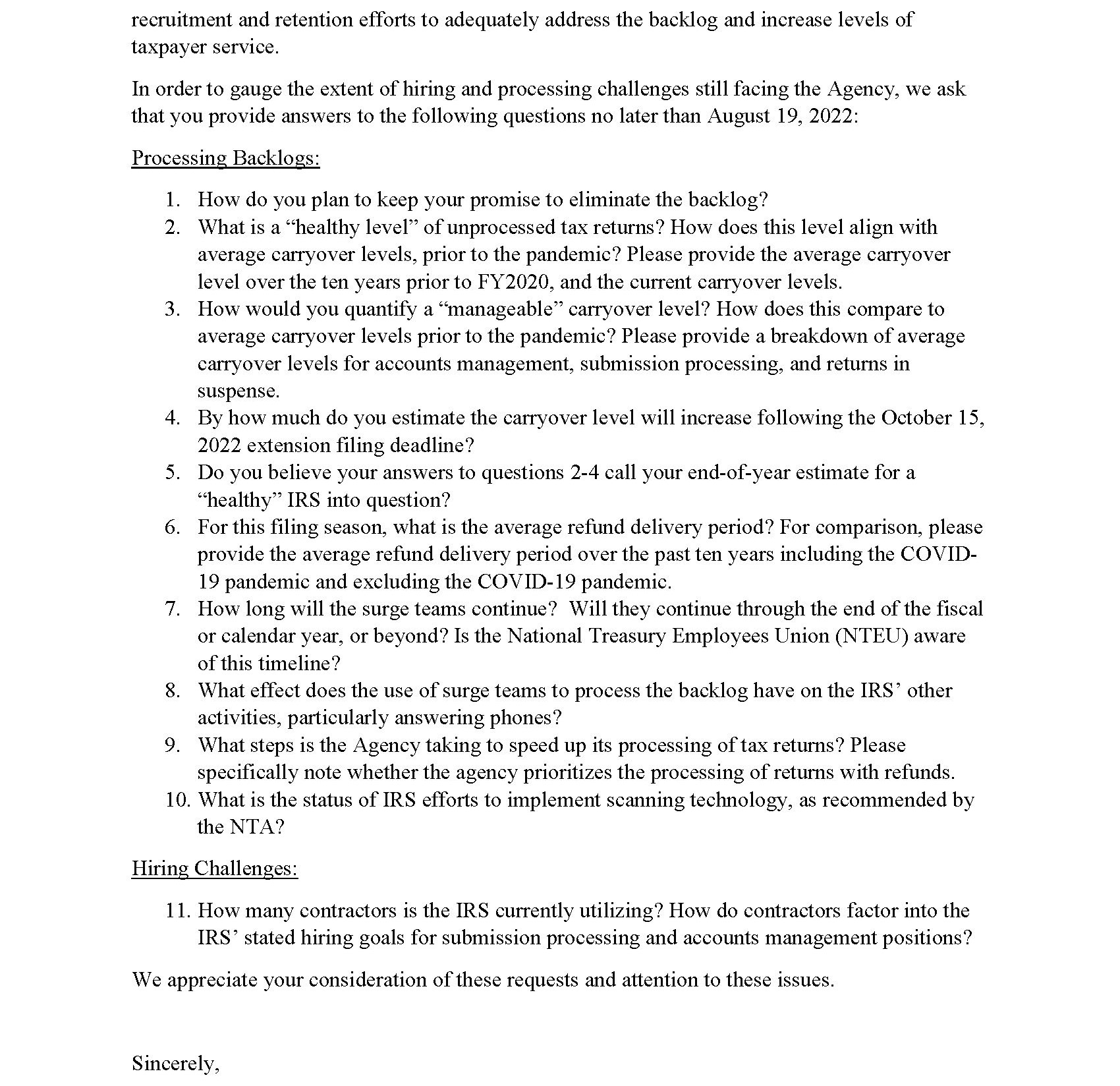

Congressional Members Sign Letter Addressing IRS Backlog

Last week the AICPA, with support from the FICPA and other state societies, secured the signatures of 93 members of Congress on a bipartisan, bicameral letter pushing the IRS to further address its backlog and ongoing service issues.

The letter, led by Abigail Spanberger (D-VA) and Brian Fitzpatrick (R-PA) in the House and Bob Menendez (D-NJ) and Bill Cassidy (R-LA) in the Senate, follows previous letters on the same topic. It asks the IRS to consider continuing the suspension of automated collections, continuing the pause on automated notices, and keeping existing surge teams in place until hiring challenges and processing backlogs are adequately addressed.

These measures – all of which the IRS can enact on its own – should lessen the risk that individual and small business taxpayers, as well as practitioners, will face a 2023 tax-filing season with unprecedented levels of unprocessed returns resulting in incorrect notices and penalties.

The FICPA contacted all of Florida’s 27 U.S. House members requesting their signatures on the letter.

As a reference, here is the AICPA’s July 11 letter to the IRS and Treasury on additional measures to reduce the backlog.

The letter from the members Congress to the IRS appears below:

Please look for updates in future issues of Advocacy Update and other FICPA communications.

DOL to Host Natural Disaster Preparedness Panel Discussion

The U.S. Department of Labor (DOL) will participate in National Disaster Preparedness Month by hosting a panel about resources and support for workers following a disaster.

The panel discussion will take place Sept. 8, 2022, from noon to 1:30 p.m. Central Standard Time. It will include representatives from DOL, the Federal Emergency Management Agency, the Small Business Administration and worker advocacy groups.

For more information, email [email protected] or [email protected]. To register for the webinar, click here.

Gov. DeSantis Appoints Bernau to Board of Pilot Commissioners

On July 22, Gov. Ron DeSantis announced several appointments to the Florida Board of Pilot Commissioners. Among them is FICPA Member Sheldon Bernau, CPA, CGMA, CDF.

Bernau, of Pensacola, is vice president and senior relationship manager at Synovus Trust Company. He is a member of the AICPA and the Northwest Florida Bar Association Foundation. He has served on the FICPA Nominations Committee and as chair of our West Florida Chapter, and currently serves as a director of the Florida CPA/PAC.

Bernau earned his bachelor’s degree in business administration and accounting from Pensacola Christian College and his master’s degree in accountancy from the University of West Florida.

The FICPA warmly congratulates Bernau on his appointment to the board of this high-profile division of the Florida Department of Business and Professional Regulation.

Bernau’s appointment is subject to confirmation by the Florida Senate.

Gov. DeSantis Eliminates ESG Considerations from State Pension Investments

On Tuesday Gov. Ron DeSantis, along with fellow Trustees of the State Board of Administration (SBA), passed a resolution directing the state of Florida’s fund managers to invest state funds in a manner that prioritizes the highest return on investment for Florida’s taxpayers and retirees without considering the ideological agenda of the environmental, social and corporate governance (ESG) movement.

The resolution specifies that investment decisions “must be based only on pecuniary factors [which] do not include the consideration of the furtherance of social, political, or ideological interests” and stipulates that the SBA “may not sacrifice investment return or take on additional investment risk to promote any non-pecuniary factors” when making investments or proxy votes. The resolution also instructs the SBA to “conduct a comprehensive review and prepare a report of the governance policies over the voting practices of the Florida Retirement System Defined Benefit Pension Plan.” The text of the resolution can be found here.

Last month, Gov. DeSantis also unveiled proposed legislation for the 2023 Legislative Session that would amend Florida’s Deceptive and Unfair Trade Practices statute to prohibit discriminatory practices by large financial institutions based on ESG social credit score metrics.

For more information, click here. To watch a video of the announcement, click here.

Auditor General Issues Review of District School Board, Charter School and Charter Technical Career Center Audit Reports

In early August, the Florida Auditor General issued Report No. 2023-008, Summary of Significant Findings and Financial Trends Identified in Charter School and Charter Technical Career Center Audit Reports for the Fiscal Year Ended June 30, 2021.

The report was issued pursuant to Section 11.45(7)(b), Florida Statutes.

You may access the report on the Auditor General’s website.

For more information or to request a hard copy of the report, please e-mail the Auditor General’s office at [email protected].

In Memoriam

We are deeply saddened to report the passing of FICPA General Counsel Kenneth R. Hart. Ken passed away Aug. 19, 2022. He was 76 years old.

Ken attended Florida State University on a football scholarship from 1964 to 1969, earning his bachelor’s and master’s degrees in accounting during that time. He was chair and CEO of Ausley McMullen where his primary area of practice was litigation. In recent years, Ken’s litigation practice mainly focused on commercial litigation, products liability, regulatory and constitutional issues. He formerly was a CPA with Price Waterhouse in Miami.

Ken’s funeral service will be held at 11 a.m. on Saturday, Aug. 27 at Faith Presbyterian Church, 2200 N. Meridian Road, in Tallahassee.

Please click here to read more about Ken’s life and passing

DOR TIPs

The Florida Department of Revenue has published these helpful Tax Information Publications (TIPs) since our last edition of Advocacy Update. You can review the full list of 2022 DOR TIPs here.

Administration

Electronic Digital Signatures

Aug. 24, 2022

The Florida Department of Revenue (Department) accepts electronic digital signatures, as they have the same force and effect as a written signature under Florida law. Taxpayers and/or their representatives may use established, secured messaging systems to submit documents with electronic digital signatures, such as power of attorney forms or other documents that must be signed.

Electronic File and Pay Requirements for Taxes, Fees and Surcharges

June 24, 2022

Effective Jan. 1, 2023, taxpayers must file tax returns and remit payments of taxes and fees electronically if the tax amount paid in the prior state fiscal year (July 1-June 30) is $5,000 or more. This requirement applies separately to each tax and is based on the amounts remitted as estimated payments, tentative payments, tax return payments or any other type of payment made for the specific tax.

Communications Services Tax

Electronic File and Pay Requirements for Taxes, Fees and Surcharges

June 24, 2022

Effective Jan. 1, 2023, taxpayers must file tax returns and remit payments of taxes and fees electronically if the tax amount paid in the prior state fiscal year (July 1-June 30) is $5,000 or more. This requirement applies separately to each tax and is based on the amounts remitted as estimated payments, tentative payments, tax return payments or any other type of payment made for the specific tax.

Fuel Tax

Electronic File and Pay Requirements for Taxes, Fees and Surcharges

June 24, 2022

Effective January 1, 2023, taxpayers must file tax returns and remit payments of taxes and fees electronically if the tax amount paid in the prior state fiscal year (July 1-June 30) is $5,000 or more. This requirement applies separately to each tax and is based on the amounts remitted as estimated payments, tentative payments, tax return payments or any other type of payment made for the specific tax.

Gross Receipts Tax

Electronic File and Pay Requirements for Taxes, Fees and Surcharges

June 24, 2022

Effective January 1, 2023, taxpayers must file tax returns and remit payments of taxes and fees electronically if the tax amount paid in the prior state fiscal year (July 1-June 30) is $5,000 or more. This requirement applies separately to each tax and is based on the amounts remitted as estimated payments, tentative payments, tax return payments or any other type of payment made for the specific tax.

Insurance Premium Tax

Electronic File and Pay Requirements for Taxes, Fees and Surcharges

June 24, 2022

Effective January 1, 2023, taxpayers must file tax returns and remit payments of taxes and fees electronically if the tax amount paid in the prior state fiscal year (July 1-June 30) is $5,000 or more. This requirement applies separately to each tax and is based on the amounts remitted as estimated payments, tentative payments, tax return payments or any other type of payment made for the specific tax.

Sales and Use Tax

New Sales and Use Tax Exemptions for Certain Machinery and Equipment Related to Hydrogen

June 30, 2022

Effective July 1, 2022, the sales and use tax exemption for purchases of machinery and equipment necessary to produce electrical or steam energy by burning boiler fuels is expanded to include purchases of machinery and equipment that burns hydrogen.

Exemption for Boiler Fuels Expanded to Include Hydrogen

June 30, 2022

Effective July 1, 2022, hydrogen purchased for use as a combustible fuel in manufacturing, processing, compounding, or producing tangible personal property for sale is exempt from sales and use tax.

Exemptions for Fencing and Trailers Used in Agricultural Production

June 29, 2022

Effective July 1, 2022, hog wire and barbed wire fencing used in agricultural production on lands classified as agricultural lands under section (s.) 193.461, Florida Statutes (F.S.), are exempt from Florida sales tax. Also exempt are gates and materials used to build or repair hog wire or barbed wire fencing.

Severance Tax

Electronic File and Pay Requirements for Taxes, Fees and Surcharges

June 24, 2022

Effective January 1, 2023, taxpayers must file tax returns and remit payments of taxes and fees electronically if the tax amount paid in the prior state fiscal year (July 1-June 30) is $5,000 or more. This requirement applies separately to each tax and is based on the amounts remitted as estimated payments, tentative payments, tax return payments or any other type of payment made for the specific tax.

Contribute

The Florida CPA/PAC supports the politicians who stand up for CPAs. We back the candidates and incumbents who will ensure CPAs and their clients are included in the legislative process. It is your voluntary contributions that help protect the CPA license.

Please note: Contributions are strictly voluntary and are not deductible for federal tax purposes. The Florida CPA/PAC is an entity completely separate from the FICPA. The Florida CPA/PAC is supported solely by the voluntary contributions of members of the FICPA and others.

Advocacy Update: Stevenson retains seat as election season heats up

With election season on the horizon, we check in on those members of the Florida Legislature who have already retained their seats, and look ahead to the role CPAs can play over the coming months.

In this June 24 edition of Advocacy Update, we address:

- The re-election of one of our CPA Lawmakers, Rep. Cyndi Stevenson

- The Gulf Coast Chapter's recent meeting with Sen. Joe Gruters

- Our recent talk with AICPA President & CEO Barry Melancon

- The Florida CPA/PAC's preparation for election season

- An advocacy-focused edition of FICPA CEO Conversations

- Florida DBPR Secretary Melanie Griffin's address at MEGA

- Our Newly Certified Ceremony honoring Florida's Young CPAs

- And more!

Rep. Stevenson re-elected without opposition

Candidates from throughout the state scurried to finalize their plans to run for state office last week ahead of the Friday qualifying deadline for the November elections. Of the more than 390 candidates who qualified to be on the ballot, 37 are celebrating their re-election because no opponents qualified to run against them.

The FICPA’s very own Rep. Cyndi Stevenson, CPA, was among those celebrating over the weekend.

“It was a wonderful surprise! I’m humbled to continue to serve my fantastic district," Rep. Stevenson said. "We have so many people who have chosen to live here. They’re counting on St. Johns County and all of Florida to continue to be a place of freedom and opportunity. I am grateful to continue to represent them and the CPA profession in the Florida House.”

Congratulations to Rep. Stevenson, CPA, and all those elected without opposition:

- Sen. Jen Bradley – District 16

- Sen. Debbie Mayfield – District 19

- Senate President Kathleen Passidomo – District 28

- Sen. Erin Grall – District 29

- Sen. Gayle Harrell – District 31

- Sen. Jason Pizzo – District 37

- Sen. Bryan Avila – District 39

- Sen. Ana Maria Rodriguez – District 40

- Rep. Patt Maney – District 4

- Rep. Jason Shoaf – District 7

- Rep Allison Tant – District 9

- Rep. Chuck Brannan – District 10

- Rep. Wyman Duggan – District 12

- Rep. Joe Harding – District 24

- Rep Stan McClain – District 27

- Rep. Tyler Sirois – District 31

- Rep. Thad Altman – District 32

- Rep. Sam Killebrew – District 48

- Rep. Melony Bell – District 49

- Rep. Dianne Hart – District 63

- Rep. Will Robinson – District 71

- Rep. James Buchanan – District 74

- Rep. Michael Grant – District 75

- Rep. Spencer Roach – District 76

- Rep. Mike Giallombardo – District 79

- Rep. Bob Rommel – District 81

- Rep. Lauren Melo – District 82

- Rep. Kaylee Tuck – District 83

- Rep. Christine Hunschofsky – District 95

- Rep. Michael Gottlieb – District 102

- Rep. Felicia Robinson – District 104

- Rep. Tom Fabricio – District 110

- Rep. David Borrero – District 111

- Rep. Alex Rizo – District 112

- Rep. Daniel Perez – District 116

- Rep. Kevin Chambliss – District 117

Gulf Coast Chapter honors Sen. Gruters

On Tuesday, FICPA Chief External Affairs Officer Justin Thames attended the FICPA’s Gulf Coast Chapter meeting in Sarasota. More than 30 members attended the meeting, where Thames provided a legislative update and presented the FICPA’s 2022 Year in Review.

Also during the meeting, the Gulf Coast Chapter officers recognized Sen. Joe Gruters for his ongoing support of the FICPA and the CPA profession. Officers presented Sen. Gruters with a plaque featuring his appearance on the Spring 2022 cover of Florida CPA Today magazine, highlighting the 2022 Legislative Session.

A chat with AICPA President & CEO Barry Melancon

With election season around the corner, our Chief External Affairs Official Justin Thames caught up with AICPA President & CEO Barry Melancon at MEGA 2022 for quick chat about the role CPAs play in the political process.

Click on the video above to enjoy this advocacy-focused conversation and consider how you can help ensure that CPAs Count in Florida and across the country.

Florida CPA/PAC prepares for upcoming elections

As part of the vetting process for the Florida CPA/PAC, the FICPA Governmental Affairs Team continues interviewing candidates running for state office as part of the Florida Chamber of Commerce Political Institute (FCPI) and Florida Association of Professional Lobbyist (FAPL) 2022 Candidate Interviews.

Through these interviews, hundreds of candidates statewide are evaluated on a rigorous set of factors, including responses to the Florida CPA/PAC’s Candidate Questionnaire.

We encourage FICPA members to submit recommendations of candidates running for state office in their local area. Please send recommendations to [email protected].

Participating in candidate interviews, receiving member recommendations and thoroughly researching candidates helps ensure the Florida CPA/PAC supports candidates who, once elected, will prioritize the interests of Florida CPAs and the future of the profession.

FICPA CEO Conversations: Shelly Weir and Justin Thames

The latest edition of Shelly Weir's FICPA CEO Conversations features an in-depth discussion on all things Tallahassee with our Chief External Affairs Officer, Justin Thames.

Shelly and Justin review the key issues from the 2022 Legislative Session and recent Special Sessions, look ahead to the 2022 election season, and discuss how to champion the CPA profession to students and the public at large.

As Justin mentions in the video, if you have a story or experience you'd like to share to help us promote the CPA profession, or would like to assist in our awareness campaign in the months ahead, contact [email protected].

AICPA’s PEEC and ASB issue new NOCLAR requirements

The new requirements for AICPA members under the AICPA Code of Conduct and Statement on Auditing Standards No. 147 outline CPAs responsibilities when they encounter noncompliance with laws or regulations (NOCLAR) when working with a client or within their employing organization.

An overview of SAS 147, which is effective for audits of financial statements for periods beginning on or after June 30, 2023, is available to AICPA members.

Secretary Melanie Griffin keynotes MEGA Conference

The FICPA was honored to welcome Florida Department of Business and Professional Regulation (DBPR) Secretary Melanie Griffin as keynote speaker at the 2022 MEGA Conference in Orlando this month. Leading DBPR and overseeing the Florida Board of Accountancy (BOA), Secretary Griffin shared insight and highlights from her first few months as head of the agency.

Secretary Griffin is an attorney with Shumaker, Loop & Kendrick and senior advisor for business-to-business relationships for Shumaker Advisors Florida. She also is the founder and owner of Spread Your Sunshine, a business that provides speaking and professional-training services and designs, manufactures and sells inspirational products and gifts.

As a small business owner, Secretary Griffin has a unique perspective on government and how DBPR can best serve its clients and constituencies. During her keynote presentation, “The DBPR and Florida CPAs: A Partnership for Success,” Secretary Griffin gave an overview of DBPR’s strategic plan, including numerous technology enhancements, and discussed her leadership style and she manages the agency.

Secretary Griffin also highlighted updates to DBPR’s newsletter and website, BOA efforts to engage and educate licensees, streamlining the licensure process, the future of compliance, and how the Clay Ford Scholarship is helping build the next generation of CPAs.

MEGA Conference celebrates new CPAs

During last week’s MEGA Conference in Orlando, the FICPA hosted a Newly Certified Ceremony. During the event, we recognized 26 newly licensed CPAs and welcomed them to our professional community.

We warmly congratulate our honorees and wish them luck as they embark on promising new careers!

- Asad Ahmad

- David Belnap

- Maria Benero

- Rachel Bollone

- Robyn Clark

- Paul Compton

- Trisha Das

- Meleah Davies

- Damone Downs

- Deanna Duell

- Danison Fronda-Tietz

- Thomas Garvey

- Nathan Gauger

- Karen Greaves

- Nathalie Heaney

- Ingrid Hernandez

- Shirley Hurley

- Paola Jimenez

- Richard Kennedy

- Ariel Mosley

- Terry Mullen

- Stacy Ann Powell

- Nathan Pritchett

- Julia Scher

- Nadine Thomas

- Samantha Willis

IRS increases mileage rate for remainder of 2022

Last Thursday, the IRS announced an increase in the optional standard mileage rate for the final six months of 2022. Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes.

For the final six months of 2022, the standard mileage rate for business travel will be 62.5 cents per mile, up four cents from the rate effective at the start of the year. The new rate for deductible medical or moving expenses (available for active-duty members of the military) will be 22 cents for the remainder of 2022, up four cents from the rate effective at the start of 2022.

These new rates become effective July 1, 2022. The IRS provided legal guidance on the new rates in Announcement 2022-13, issued today. For travel from Jan. 1 through June 30, 2022, taxpayers should use the rates set forth in Notice 2022-03.

Midyear increases in the optional mileage rates are rare. The IRS last made such an increase in 2011.

|

Purpose |

Rates 1/1 through 6/30/22 |

Rates 7/1 through 12/31/22 |

|

Business |

58.5 |

62.5 |

|

Medical/Moving |

18 |

22 |

|

Charitable |

14 |

14 |

Four sales tax holidays begin July 1

Beginning next Friday, July 1, consumers can purchase qualifying supplies exempt from tax during four sales and use tax holidays.

Tax exemptions beginning July 1 include admission fees and outdoor activity supplies; ENERGY STAR appliances; children’s diapers and apparel; and impact-resistant doors, garage doors and windows.

DOR’s Tax Information Publications (TIPs) outline qualifying items. The Freedom Week tax holiday extends through July 7, 2022. The tax holidays on appliances and children’s items extend through June 30, 2023. And the tax holiday on impact-resistant doors, garage doors and windows extends through June 30, 2024.

DOR TIPs

The Florida Department of Revenue has published these helpful Tax Information Publications (TIPs) in 2022.

Current Interest Rates

Floating Rate of Interest Remains at 7 Percent for the Period July 1, 2022, Through December 31, 2022

May 4, 2022

The rate of interest for the period July 1, 2022, through December 31, 2022, is 7 percent. The daily interest rate factor to be used for this period is 0.000191781. The daily interest rate is named a factor because it is not expressed as a percentage. This rate is subject to change effective January 1, 2023.

Administration

Florida Tax Credit Scholarship Program Tax Credit Cap Will Increase

June 6, 2022

Section 1002.395(5), Florida Statutes, provides an increase of 25 percent of the tax credit cap when the annual tax credit amount for the prior fiscal year is equal to or greater than 90 percent of the tax credit cap applicable to that year. The tax credit amount allocated for the 2021-2022 state fiscal year now exceeds 90 percent of the $873,565,674 tax credit cap. Therefore, the tax credit cap amount will increase to $1,091,957,093 ($873,565,674 times 125 percent [1.25]) for the 2022-2023 state fiscal year.

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit 2022 Legislative Changes

May 11, 2022

Taxpayers with corporate income/franchise taxable years beginning on or after January 1, 2021, may apply to the Florida Department of Revenue (Department) for an allocation of the tax credits available for state fiscal year 2021-2022. The application must be filed by the day before the due date of the Florida Corporate Income/Franchise Tax Return (Form F-1120), or if extended, the day before the extended due date. The Department will send notification of approval or denial of the request for an allocation of the tax credits.

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit for Corporate Income Tax and Insurance Premium Tax

April 28, 2022

Legislation is currently pending that would allow corporate income taxpayers and insurance premium taxpayers to seek a tax credit allocation from the 2021-2022 state fiscal year cap. The Department is accepting applications based on the pending legislation. Allocation approvals are subject to the legislation becoming law.

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit

Feb. 7, 2022

Florida’s New Worlds Reading Initiative was established in 2021 under the Florida Department of Education to improve literacy skills and promote a love of reading by providing high-quality, free books to students in kindergarten through fifth grade who are reading below grade level. Florida’s Strong Families Tax Credit was established in 2021 under the Florida Department of Children and Families to provide services to prevent child abuse, engage absent fathers in being more active in their children’s lives, provide books to eligible children, and assist families of children with chronic illness.

Communications Services Tax

Change in Local Communications Services Tax Rate Beginning May 1, 2022

Jan. 27, 2022

Beginning May 1, 2022, the local communications services tax (CST) rate for the Town of Astatula will change. The total local CST rate includes: (1) the local rate imposed under the CST statute; and (2) any county discretionary sales surtax imposed under the sales and use tax statute.

Corporate Income Tax

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit 2022 Legislative Changes

May 11, 2022

Taxpayers with corporate income/franchise taxable years beginning on or after January 1, 2021, may apply to the Florida Department of Revenue (Department) for an allocation of the tax credits available for state fiscal year 2021-2022. The application must be filed by the day before the due date of the Florida Corporate Income/Franchise Tax Return (Form F-1120), or if extended, the day before the extended due date. The Department will send notification of approval or denial of the request for an allocation of the tax credits.

Florida Corporate Income Tax Adoption of 2022 Internal Revenue Code

May 9, 2022

Each year, the Florida Legislature must consider adopting the current Internal Revenue Code (Title 26, United States Code) to ensure certain tax definitions and the calculation of adjusted federal income will be consistent between the Internal Revenue Code (IRC) and the Florida Income Tax Code (Chapter 220, Florida Statutes [F.S.]). The Florida corporate income tax “piggybacks” federal income tax determinations and uses adjusted federal income as the starting point for computing Florida net income.

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit for Corporate Income Tax and Insurance Premium Tax

April 28, 2022

Legislation is currently pending that would allow corporate income taxpayers and insurance premium taxpayers to seek a tax credit allocation from the 2021-2022 state fiscal year cap. The Department is accepting applications based on the pending legislation. Allocation approvals are subject to the legislation becoming law.

Florida Corporate Income Tax 2022 Automatic Refund

Jan. 13, 2022

An automatic refund is available for Florida corporate income/franchise tax returns filed on or before Feb. 1, 2022, for taxable years beginning on or after April 1, 2019, and on or before March 31, 2020 (subject to any 2022 law change). For most taxpayers, this will be the return for taxable year ending Dec. 31, 2020.

Florida Corporate Income/Franchise Tax – Internship Tax Credit Program

Jan. 4, 2022

For taxable years beginning during the 2022 and 2023 calendar year, a student internship tax credit is available against the Florida corporate income/franchise tax. The Florida Internship Tax Credit Program (Program) allows credit for up to five student interns per taxable year, per corporation. The credit amount is $2,000 per student intern (maximum of $10,000 for each taxable year). A total of $2.5 million in credits are available for each of the two years of the Program.

Fuel Tax

Florida Motor Fuel Tax Relief Act of 2022 October 1, 2022 through October 31, 2022 – Local Gov't and Mass Transit System Operators

June 14, 2022

The Florida Motor Fuel Tax Relief Act of 2022 reduces the tax rate on motor fuel by 25.3 cents per gallon from Saturday, October 1, 2022 through Monday, October 31, 2022. The reduced tax rate applies to all gasoline products, any product blended with gasoline, or any fuel placed in the storage supply tank of a gasoline-powered motor vehicle.

Florida Motor Fuel Tax Relief Act of 2022 October 1, 2022 through October 31, 2022 – Retail Dealers

June 14, 2022

The Florida Motor Fuel Tax Relief Act of 2022 reduces the tax rate on motor fuel by 25.3 cents per gallon from Saturday, October 1, 2022 through Monday, October 31, 2022. The reduced tax rate applies to all gasoline products, any product blended with gasoline, or any fuel placed in the storage supply tank of a gasoline-powered motor vehicle.

Florida Motor Fuel Tax Relief Act of 2022 October 1, 2022 through October 31, 2022 – Terminal Suppliers

June 14, 2022

The Florida Motor Fuel Tax Relief Act of 2022 reduces the tax rate on motor fuel by 25.3 cents per gallon from Saturday, October 1, 2022 through Monday, October 31, 2022. The reduced tax rate applies to all gasoline products, any product blended with gasoline, or any fuel placed in the storage supply tank of a gasoline-powered motor vehicle.

Florida Motor Fuel Tax Relief Act of 2022 October 1, 2022 through October 31, 2022 – Wholesalers and Importers

June 14, 2022

The Florida Motor Fuel Tax Relief Act of 2022 reduces the tax rate on motor fuel by 25.3 cents per gallon from Saturday, October 1, 2022 through Monday, October 31, 2022. The reduced tax rate applies to all gasoline products, any product blended with gasoline, or any fuel placed in the storage supply tank of a gasoline-powered motor vehicle.

Gross Receipts Tax

Gross Receipts Tax Index Prices for the Period July 1, 2022 Through June 30, 2023

May 20, 2022

Every year on July 1, the index prices used by distribution companies to calculate the gross receipts tax on the sale or transportation of natural or manufactured gas to retail consumers are adjusted as provided by law. Beginning with customer bills dated on or after July 1, 2022, distribution companies must use the index prices listed below when completing the Gross Receipts Tax Return (Form DR-133).

Insurance Premium Tax

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit 2022 Legislative Changes

May 11, 2022

Taxpayers with corporate income/franchise taxable years beginning on or after January 1, 2021, may apply to the Florida Department of Revenue (Department) for an allocation of the tax credits available for state fiscal year 2021-2022. The application must be filed by the day before the due date of the Florida Corporate Income/Franchise Tax Return (Form F-1120), or if extended, the day before the extended due date. The Department will send notification of approval or denial of the request for an allocation of the tax credits.

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit for Corporate Income Tax and Insurance Premium Tax

April 28, 2022

Legislation is currently pending that would allow corporate income taxpayers and insurance premium taxpayers to seek a tax credit allocation from the 2021-2022 state fiscal year cap. The Department is accepting applications based on the pending legislation. Allocation approvals are subject to the legislation becoming law.

Intangible Tax

2022 Governmental Leasehold Intangible Tax Valuation Factor Table

Jan. 5, 2022

Florida law provides that all leasehold estates or related possessory interest in property of the United States, the State of Florida or any of its political subdivisions, municipalities, agencies, authorities or other governmental units are taxed as intangible personal property if the leased property is undeveloped or predominantly used for a residential or commercial purpose and rental payments are due in consideration of the leasehold estate or possessory interest. Unless the leasehold estate qualifies for specific exemptions, lessees of governmentally owned property are required to file an annual intangible tax return.

Sales and Use Tax

Electronic File and Pay Requirements for Taxes, Fees, and Surcharges

June 24, 2022

Effective January 1, 2023, taxpayers must file tax returns and remit payments of taxes and fees electronically if the tax amount paid in the prior state fiscal year (July 1 – June 30) is $5,000 or more. This requirement applies separately to each tax and is based on the amounts remitted as estimated payments, tentative payments, tax return payments, or any other type of payment made for the specific tax.

Indexed Tax on Asphalt Increases to 98 Cents Per Ton for the Period July 1, 2022 Through June 30, 2023

June 9, 2022

The tax rate used by contractors who manufacture and use asphalt during fiscal year July 1, 2022 through June 30, 2023, will increase from 84 cents per ton to 98 cents per ton. The indexed tax is adjusted on July 1 of each year, using a producer price index published by the U.S. Department of Labor, Bureau of Labor Statistics.

State Sales Tax Rate Imposed on Retail Sales of New Mobile Homes Reduced to 3%

May 27, 2022

Beginning July 1, 2022, the state sales tax rate imposed on the retail sale of a new mobile home is reduced from 6% to 3%. Any applicable discretionary sales surtax (local option sales tax) continues to apply.

Tax-Exempt Admissions Expanded

May 24, 2022

Effective July 1, 2022, admissions to certain FIFA World Cup matches, Formula One Grand Prix races and Daytona 500 races are exempt from sales tax.

2022 Sales Tax Exemption Period on Children’s Books – May 14, 2022, Through August 14, 2022

May 6, 2022

Florida’s first sales tax exemption period on children’s books begins Saturday, May 14, 2022, and ends Sunday, August 14, 2022. During the sales tax exemption period, tax is not due on the retail sale of children’s books.

2022 Disaster Preparedness Sales Tax Holiday May 28, 2022, Through June 10, 2022

May 6, 2022

The 2022 Disaster Preparedness Sales Tax Holiday begins on Saturday, May 28, 2022, and ends on Friday, June 10, 2022. During the sales tax holiday period, tax is not due on the retail sale of eligible items related to disaster preparedness.

Freedom Week Sales Tax Holiday on Specific Admissions and Outdoor Activity Supplies July 1, 2022, Through July 7, 2022

May 6, 2022

The sales tax holiday begins on Friday, July 1, 2022, and ends on Thursday, July 7, 2022. During this sales tax holiday period, tax is not due on the retail sale of admissions to music events, sporting events, cultural events, specified performances, movies, museums, state parks, and fitness facilities. Also exempt from sales tax during this holiday period are eligible boating and water activity supplies, camping supplies, fishing supplies, general outdoor supplies, residential pool supplies and sporting equipment.

Sales Tax Exemption Period on New ENERGY STAR Appliances – July 1, 2022, Through June 30, 2023

May 6, 2022

Florida’s sales tax exemption period on new ENERGY STAR appliances for noncommercial use begins Friday, July 1, 2022, and ends Friday, June 30, 2023. During this sales tax exemption period, tax is not due on the retail sale of eligible new ENERGY STAR appliances purchased for noncommercial use. The rental of eligible new ENERGY STAR appliances does not qualify for the exemption.

Sales Tax Exemption Period on Children's Diapers and Baby and Toddler Clothing, Apparel and Shoes – July 1, 2022, Through June 30, 2023

May 6, 2022

Florida’s first sales tax exemption period on children’s diapers and baby and toddler clothing, apparel, and shoes begins Friday, July 1, 2022, and ends Friday, June 30, 2023. During this sales tax exemption period, tax is not due on the retail sale of children’s diapers or on baby and toddler clothing, apparel, and shoes primarily intended for children age 5 or younger

Sales Tax Exemption Period on Impact-Resistant Doors, Garage Doors, and Windows – July 1, 2022, Through June 30, 2024

May 6, 2022

A temporary sales tax exemption period on impact-resistant doors, impact-resistant garage doors, and impact-resistant windows begins July 1, 2022, and ends June 30, 2024. During this sales tax exemption period, tax is not due on the retail sales of impact-resistant doors, impact-resistant garage doors, and impact-resistant windows for commercial or noncommercial use.

2022 Back-to-School Sales Tax Holiday – July 25, 2022, Through August 7, 2022

May 6, 2022

During the sales tax holiday period, tax is not due on the retail sale of:

- Clothing, footwear, and certain accessories with a sales price of $100 or less per item*

- Certain school supplies with a sales price of $50 or less per item,

- Learning aids and jigsaw puzzles with a sales price of $30 or less*

- Personal computers and certain computer-related accessories with a sales price of $1,500 or less, when purchased for noncommercial home or personal use

- Read the full TIP here.

2022 Sales Tax Holiday for Tools Commonly Used by Skilled Trade Workers – September 3, 2022, Through September 9, 2022

May 6, 2022

Florida’s 2022 ‘Tool Time’ Sales Tax Holiday begins on Saturday, September 3, 2022, and ends on Friday, September 9, 2022. During this sales tax holiday period, tax is not due on the retail sale of eligible items related to tools commonly used by skilled trade workers.

Madison County Increases Its Tourist Development Tax Rate From 3% to 5%

Jan. 5, 2022

The Madison County Board of County Commissioners adopted Ordinance No. 2021-246 increasing the tourist development tax rate from 3% to 5% on transient rental transactions occurring in Madison County.

Severance Tax

Gas and Sulfur Production Tax Rates for 2022-2023

May 10, 2022

On July 1 of each year, the tax rates for production of gas and sulfur are adjusted as provided by law. The adjusted rates must be used when completing the Declaration of Estimated Gas and Sulfur Production Tax (Form DR-144ES) beginning with the July 2022 estimated payment. Form DR-144ES will be mailed to all active accounts during the last week of July.

Solid Mineral Tax Rates for 2022

March 21, 2022

Phosphate rock producers are subject to tax as provided by law. Use the following rate when completing the Declaration/Installment Payment of Estimated Solid Mineral Severance Tax (Form DR-142ES).

Contribute

The Florida CPA/PAC supports the politicians who stand up for CPAs. We back the candidates and incumbents who will ensure CPAs and their clients are included in the legislative process. It is your voluntary contributions that help protect the CPA license.

Please note: Contributions are strictly voluntary and are not deductible for federal tax purposes. The Florida CPA/PAC is an entity completely separate from the FICPA. The Florida CPA/PAC is supported solely by the voluntary contributions of members of the FICPA and others.

Advocacy Update: Legislature passes condo reform in Special Session

The Florida Legislature reconvened this week for its latest Special Session, passing both condominium and property insurance reforms, which have been signed into law by Gov. Ron DeSantis.

In this May 27 edition of Advocacy Update, we address:

- What you need to know about the new condo regulations

- The details of the new property insurance law

- Our recently released, advocacy-focused issue of Florida CPA Today magazine

- The Disaster Preparedness Sales Tax Holiday beginning this Saturday

- IRS FAQ updates for the 2021 Child Tax Credit and Advance Child Tax Credit

- And the latest Department of Revenue TIPs

Latest News

Legislature Adds Condo Reform to Special Session

This week, the Florida Legislature convened in a Special Session to consider legislation related to property insurance, reinsurance, changes to the Florida Building Code to improve the affordability of property insurance, the Office of Insurance Regulation, civil remedies and appropriations.

On Tuesday, the Legislature expanded the scope of the Special Session to include legislation addressing the tragic Surfside Chaplain Towers condominium collapse in June 2021. In the Legislature’s announcement, Florida's future House Speaker, Rep. Danny Perez, expressed his aspirations for the changes adopted this week.

“After I witnessed the tragedy of Surfside, the No. 1 priority for me this past session was to pass meaningful condominium reform,” Rep. Perez said. “I have always been willing to discuss what that looks like, but I was never willing to pass legislation that did not solve the real issue, which is to ensure there is association funding to fix the problems discovered during inspections. I am hopeful, with the commitments from Senate leadership, to pass real reform this Special Session, and in doing so honor the lives lost as well as the survivors and their loved ones.”

The legislation, House Bill 5D, amends Florida’s Building Codes Act, Condominium Act and Cooperative Act to enact new requirements meant to address concerns raised in the aftermath of the collapse. The House Appropriations Committee considered the bill late Tuesday and amended it to the Senate’s roofing bill related to property insurance. The legislation passed both chambers Wednesday and Gov. DeSantis signed it into law Thursday.

Here’s what you need to know about the new law:

1. Requires milestone structural inspections for condominium and cooperative association buildings three stories in height and 30 years old by licensed architect or engineer by Dec. 31, 2024

2. Requires “structural integrity reserve studies” for condominium and cooperative associations at least every 10 years. The following items are required to be included:

- Roof

- Load-bearing walls or other primary structural members

- Floor

- Foundation

- Fireproofing and fire protection systems

- Plumbing

- Electrical systems

- Waterproofing and exterior painting

- Windows

- Any other item that has a deferred maintenance expense or replacement cost that exceeds $10,000 and the failure to replace or maintain such item negatively affects the items listed above as determined by the licensed engineer or architect performing the visual inspection portion of the structural integrity reserve study

3. Effective Dec. 1, 2024, an association or the developer may not waive funding reserves

4. Requires structural integrity reserve studies to be provided to unit owners, developers, buyers and renters

5. Requires condominium and cooperative associations to provide the following information to the Florida Division of Condominiums, Timeshares and Mobile Homes by Jan. 1, 2023:

- The number of buildings in the association that are three stories or higher in height

- The number of units in such buildings

- The address of such buildings

- The counties in which all buildings are located

For more information about the changes, read House Bill 5D and House Analysis of House Bill 5D.

Property Insurance Bills Considered During Session D

In advance of Special Session 2022D, House Speaker Chris Sprowls (R-Clearwater) and Senate President Wilton Simpson (R-Trilby) released memorandums highlighting property insurance legislation that was passed on May 25 and signed into law on May 26.

SB 2D will do the following:

- Create the Reinsurance to Assist Policyholders (RAP) program for insurance companies and allocate $2 billion to the program. The coverage will be at no cost to the insurer and will allow quicker reimbursement for hurricane damages.

- Allocate $150 million for the My Safe Florida Home Program, which will provide funding to residents for hurricane mitigation inspections and grant funding for home hardening upgrades. For every dollar that the homeowner provides, the program will provide $2, allowing homeowners to receive up to $10,000.

- Prohibit contractors from soliciting consumers to make a claim for roof damage unless the solicitation states the consumer must pay the deductible, that a contractor paying or waiving the deductible is a felony and that it is a felony to knowingly file a claim that contains false, misleading or fraudulent information.

- Prohibit insurers from refusing to write or renew a policy on homes with roofs based solely on a roof’s age (less than 15 years old). If a roof is at least 15 years old, insurers must allow the homeowner to have a roof inspection before the homeowner has to replace the roof in order to obtain or renew an insurance policy.

- Limit contingency risk multipliers by allowing attorney fee multipliers in insurance litigation only in specific and rare situations. Eliminate attorney fee awards in assignment of benefits cases and prevent transfers or assignment to collect attorney fees in property insurance litigation.

- Require a policyholder to prove the property insurance company breached its contract before winning a bad faith lawsuit. Require a policyholder to opt out of a separate roof deductible and ensure the roof deductible provision is unambiguous and clear.

- Analyze an insurer’s failure within two months after the insurance company is referred to the Department of Financial Services’ (DFS) Division of Rehabilitation and Liquidation. DFS must review the Office of Insurance Regulation's oversight of the failed insurer.

- Establish an exception to the Florida Building Code to allow roofs that are more than 25 percent damaged but comply with the 2007 Florida Building Code to be repaired instead of mandatory replacement.

- Require insurers to notify a policyholder that they are able to request a copy of an estimate of the loss generated by the insurance adjuster. The insurer must send the estimate to the policyholder within seven days after receiving the request.

Available Now: Florida CPA Today – 2022 Legislative Report

The Spring 2022 Legislative Edition of Florida CPA Today is now available online!

In this advocacy-focused issue, you'll find:

- An in-depth breakdown of Florida's 2022 Legislative Session

- An exclusive Q&A with Florida DBPR Secretary Melanie Griffin

- A recap of our 2022 FICPA Advocacy Days

- Articles on the CPA exam, Florida's 2022 tax package, and changes to the Department of Revenue’s audit process

Click here to enjoy our annual legislative issue!

Disaster Preparedness Sales Tax Holiday and Additional Resources

Earlier this week, the FICPA published a special edition of Advocacy Update focused on disaster preparedness. With hurricane season nearly here, we encourage you to review these resources today to make sure you're ready for every eventuality in the weeks and months to come.

We also want to remind you that, beginning this Saturday, May 28, consumers can purchase qualifying disaster preparedness supplies exempt from tax during the 2022 Disaster Preparedness Sales Tax Holiday.

“Hurricane season can be a trying time but preparing in advance for disasters is the best way to stay safe,” said Jim Zingale, Executive Director of the Florida Department of Revenue (DOR). “The 2022 Disaster Preparedness Sales Tax Holiday helps families stock up on essentials while saving money.”

DOR’s Tax Information Publication (TIP) outlines qualifying items ranging from cans or pouches of wet pet food selling for $2 or less to portable generators selling for $1,000 or less. The sales tax holiday extends through June 10.

IRS Revises 2021 Child Tax Credit and Advance Child Tax Credit

The IRS has issued a Fact Sheet updating the 2021 Child Tax Credit and Advance Child Tax Credit frequently asked questions (FAQs). The updates help eligible families properly claim the credit when they prepare and file their 2021 tax return.

The FAQs revisions are:

- • Topic A: General Information: updated questions 1-5, 8-11, 13- 16

- • Topic E: Advance Payment Process of the Child Tax Credit: updated questions 2-3

- • Topic F: Updating Your Child Tax Credit Information During 2021: removed questions 1-2 and updated 3-4

- • Topic G: Receiving Advance Child Tax Credit Payments: updated questions 1, 6-7, 9-11

- • Topic H: Reconciling Your Advance Child Tax Credit Payments on Your 2021 Tax Return: updated questions 1-2, 9 and removed 10

- • Topic J: Unenrolling from Advance Payments: updated question 1 and removed 2-7

- • Topic K: Verifying Your Identity to View your Payments 2021 Child Tax Credit: Updated 2-3,5-6 and removed 7

- • Topic L: Commonly Asked Shared-Custody Questions: Updated 1-2

Click here to read the full IRS Fact Sheet.

DOR TIPs

The Florida Department of Revenue has published these helpful Tax Information Publications (TIPs) in 2022.

Current Interest Rates

Floating Rate of Interest Remains at 7 Percent for the Period July 1, 2022, Through December 31, 2022

May 4, 2022

The rate of interest for the period July 1, 2022, through December 31, 2022, is 7 percent. The daily interest rate factor to be used for this period is 0.000191781. The daily interest rate is named a factor because it is not expressed as a percentage. This rate is subject to change effective January 1, 2023.

Administration

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit 2022 Legislative Changes

May 11, 2022

Taxpayers with corporate income/franchise taxable years beginning on or after January 1, 2021, may apply to the Florida Department of Revenue (Department) for an allocation of the tax credits available for state fiscal year 2021-2022. The application must be filed by the day before the due date of the Florida Corporate Income/Franchise Tax Return (Form F-1120), or if extended, the day before the extended due date. The Department will send notification of approval or denial of the request for an allocation of the tax credits.

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit for Corporate Income Tax and Insurance Premium Tax

April 28, 2022

Legislation is currently pending that would allow corporate income taxpayers and insurance premium taxpayers to seek a tax credit allocation from the 2021-2022 state fiscal year cap. The Department is accepting applications based on the pending legislation. Allocation approvals are subject to the legislation becoming law.

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit

Feb. 7, 2022

Florida’s New Worlds Reading Initiative was established in 2021 under the Florida Department of Education to improve literacy skills and promote a love of reading by providing high-quality, free books to students in kindergarten through fifth grade who are reading below grade level. Florida’s Strong Families Tax Credit was established in 2021 under the Florida Department of Children and Families to provide services to prevent child abuse, engage absent fathers in being more active in their children’s lives, provide books to eligible children, and assist families of children with chronic illness.

Communications Services Tax

Change in Local Communications Services Tax Rate Beginning May 1, 2022

Jan. 27, 2022

Beginning May 1, 2022, the local communications services tax (CST) rate for the Town of Astatula will change. The total local CST rate includes: (1) the local rate imposed under the CST statute; and (2) any county discretionary sales surtax imposed under the sales and use tax statute.

Corporate Income Tax

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit 2022 Legislative Changes

May 11, 2022

Taxpayers with corporate income/franchise taxable years beginning on or after January 1, 2021, may apply to the Florida Department of Revenue (Department) for an allocation of the tax credits available for state fiscal year 2021-2022. The application must be filed by the day before the due date of the Florida Corporate Income/Franchise Tax Return (Form F-1120), or if extended, the day before the extended due date. The Department will send notification of approval or denial of the request for an allocation of the tax credits.

Florida Corporate Income Tax Adoption of 2022 Internal Revenue Code

May 9, 2022

Each year, the Florida Legislature must consider adopting the current Internal Revenue Code (Title 26, United States Code) to ensure certain tax definitions and the calculation of adjusted federal income will be consistent between the Internal Revenue Code (IRC) and the Florida Income Tax Code (Chapter 220, Florida Statutes [F.S.]). The Florida corporate income tax “piggybacks” federal income tax determinations and uses adjusted federal income as the starting point for computing Florida net income.

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit for Corporate Income Tax and Insurance Premium Tax

April 28, 2022

Legislation is currently pending that would allow corporate income taxpayers and insurance premium taxpayers to seek a tax credit allocation from the 2021-2022 state fiscal year cap. The Department is accepting applications based on the pending legislation. Allocation approvals are subject to the legislation becoming law.

Florida Corporate Income Tax 2022 Automatic Refund

Jan. 13, 2022

An automatic refund is available for Florida corporate income/franchise tax returns filed on or before Feb. 1, 2022, for taxable years beginning on or after April 1, 2019, and on or before March 31, 2020 (subject to any 2022 law change). For most taxpayers, this will be the return for taxable year ending Dec. 31, 2020.

Florida Corporate Income/Franchise Tax – Internship Tax Credit Program

Jan. 4, 2022

For taxable years beginning during the 2022 and 2023 calendar year, a student internship tax credit is available against the Florida corporate income/franchise tax. The Florida Internship Tax Credit Program (Program) allows credit for up to five student interns per taxable year, per corporation. The credit amount is $2,000 per student intern (maximum of $10,000 for each taxable year). A total of $2.5 million in credits are available for each of the two years of the Program.

Gross Receipts Tax

Gross Receipts Tax Index Prices for the Period July 1, 2022 Through June 30, 2023

May 20, 2022

Every year on July 1, the index prices used by distribution companies to calculate the gross receipts tax on the sale or transportation of natural or manufactured gas to retail consumers are adjusted as provided by law. Beginning with customer bills dated on or after July 1, 2022, distribution companies must use the index prices listed below when completing the Gross Receipts Tax Return (Form DR-133).

Insurance Premium Tax

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit 2022 Legislative Changes

May 11, 2022

Taxpayers with corporate income/franchise taxable years beginning on or after January 1, 2021, may apply to the Florida Department of Revenue (Department) for an allocation of the tax credits available for state fiscal year 2021-2022. The application must be filed by the day before the due date of the Florida Corporate Income/Franchise Tax Return (Form F-1120), or if extended, the day before the extended due date. The Department will send notification of approval or denial of the request for an allocation of the tax credits.

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit for Corporate Income Tax and Insurance Premium Tax

April 28, 2022

Legislation is currently pending that would allow corporate income taxpayers and insurance premium taxpayers to seek a tax credit allocation from the 2021-2022 state fiscal year cap. The Department is accepting applications based on the pending legislation. Allocation approvals are subject to the legislation becoming law.

Intangible Tax

2022 Governmental Leasehold Intangible Tax Valuation Factor Table

Jan. 5, 2022

Florida law provides that all leasehold estates or related possessory interest in property of the United States, the State of Florida or any of its political subdivisions, municipalities, agencies, authorities or other governmental units are taxed as intangible personal property if the leased property is undeveloped or predominantly used for a residential or commercial purpose and rental payments are due in consideration of the leasehold estate or possessory interest. Unless the leasehold estate qualifies for specific exemptions, lessees of governmentally owned property are required to file an annual intangible tax return.

Sales and Use Tax

State Sales Tax Rate Imposed on Retail Sales of New Mobile Homes Reduced to 3%

May 27, 2022

Beginning July 1, 2022, the state sales tax rate imposed on the retail sale of a new mobile home is reduced from 6% to 3%. Any applicable discretionary sales surtax (local option sales tax) continues to apply.

Tax-Exempt Admissions Expanded

May 24, 2022

Effective July 1, 2022, admissions to certain FIFA World Cup matches, Formula One Grand Prix races and Daytona 500 races are exempt from sales tax.

2022 Sales Tax Exemption Period on Children’s Books – May 14, 2022, Through August 14, 2022

May 6, 2022

Florida’s first sales tax exemption period on children’s books begins Saturday, May 14, 2022, and ends Sunday, August 14, 2022. During the sales tax exemption period, tax is not due on the retail sale of children’s books.

2022 Disaster Preparedness Sales Tax Holiday May 28, 2022, Through June 10, 2022

May 6, 2022

The 2022 Disaster Preparedness Sales Tax Holiday begins on Saturday, May 28, 2022, and ends on Friday, June 10, 2022. During the sales tax holiday period, tax is not due on the retail sale of eligible items related to disaster preparedness.

Freedom Week Sales Tax Holiday on Specific Admissions and Outdoor Activity Supplies July 1, 2022, Through July 7, 2022

May 6, 2022

The sales tax holiday begins on Friday, July 1, 2022, and ends on Thursday, July 7, 2022. During this sales tax holiday period, tax is not due on the retail sale of admissions to music events, sporting events, cultural events, specified performances, movies, museums, state parks, and fitness facilities. Also exempt from sales tax during this holiday period are eligible boating and water activity supplies, camping supplies, fishing supplies, general outdoor supplies, residential pool supplies and sporting equipment.

Sales Tax Exemption Period on New ENERGY STAR Appliances – July 1, 2022, Through June 30, 2023

May 6, 2022

Florida’s sales tax exemption period on new ENERGY STAR appliances for noncommercial use begins Friday, July 1, 2022, and ends Friday, June 30, 2023. During this sales tax exemption period, tax is not due on the retail sale of eligible new ENERGY STAR appliances purchased for noncommercial use. The rental of eligible new ENERGY STAR appliances does not qualify for the exemption.

Sales Tax Exemption Period on Children's Diapers and Baby and Toddler Clothing, Apparel and Shoes – July 1, 2022, Through June 30, 2023

May 6, 2022

Florida’s first sales tax exemption period on children’s diapers and baby and toddler clothing, apparel, and shoes begins Friday, July 1, 2022, and ends Friday, June 30, 2023. During this sales tax exemption period, tax is not due on the retail sale of children’s diapers or on baby and toddler clothing, apparel, and shoes primarily intended for children age 5 or younger

Sales Tax Exemption Period on Impact-Resistant Doors, Garage Doors, and Windows – July 1, 2022, Through June 30, 2024

May 6, 2022

A temporary sales tax exemption period on impact-resistant doors, impact-resistant garage doors, and impact-resistant windows begins July 1, 2022, and ends June 30, 2024. During this sales tax exemption period, tax is not due on the retail sales of impact-resistant doors, impact-resistant garage doors, and impact-resistant windows for commercial or noncommercial use.

2022 Back-to-School Sales Tax Holiday – July 25, 2022, Through August 7, 2022

May 6, 2022

During the sales tax holiday period, tax is not due on the retail sale of:

- Clothing, footwear, and certain accessories with a sales price of $100 or less per item*

- Certain school supplies with a sales price of $50 or less per item,

- Learning aids and jigsaw puzzles with a sales price of $30 or less*

- Personal computers and certain computer-related accessories with a sales price of $1,500 or less, when purchased for noncommercial home or personal use

- Read the full TIP here.

2022 Sales Tax Holiday for Tools Commonly Used by Skilled Trade Workers – September 3, 2022, Through September 9, 2022

May 6, 2022

Florida’s 2022 ‘Tool Time’ Sales Tax Holiday begins on Saturday, September 3, 2022, and ends on Friday, September 9, 2022. During this sales tax holiday period, tax is not due on the retail sale of eligible items related to tools commonly used by skilled trade workers.

Madison County Increases Its Tourist Development Tax Rate From 3% to 5%

Jan. 5, 2022

The Madison County Board of County Commissioners adopted Ordinance No. 2021-246 increasing the tourist development tax rate from 3% to 5% on transient rental transactions occurring in Madison County.

Severance Tax

Gas and Sulfur Production Tax Rates for 2022-2023

May 10, 2022

On July 1 of each year, the tax rates for production of gas and sulfur are adjusted as provided by law. The adjusted rates must be used when completing the Declaration of Estimated Gas and Sulfur Production Tax (Form DR-144ES) beginning with the July 2022 estimated payment. Form DR-144ES will be mailed to all active accounts during the last week of July.

Solid Mineral Tax Rates for 2022

March 21, 2022

Phosphate rock producers are subject to tax as provided by law. Use the following rate when completing the Declaration/Installment Payment of Estimated Solid Mineral Severance Tax (Form DR-142ES).

Contribute

The Florida CPA/PAC supports the politicians who stand up for CPAs. We back the candidates and incumbents who will ensure CPAs and their clients are included in the legislative process. It is your voluntary contributions that help protect the CPA license.

Please note: Contributions are strictly voluntary and are not deductible for federal tax purposes. The Florida CPA/PAC is an entity completely separate from the FICPA. The Florida CPA/PAC is supported solely by the voluntary contributions of members of the FICPA and others.