What is a CPA?

The certified public accountant (CPA) license is a symbol of trust. CPAs not only serve the public interest, but also act as the backbone of the business community. By becoming a CPA, you immediately put yourself in high demand in an economic environment that needs both high-quality financial reporting and rigorous tax compliance. Whether you're assisting a small business, joining a Big Four firm, working in private industry or serving in the public sector, your license gives you the freedom to craft your career on your terms.

Benefits of Earning Your CPA

- Becoming a CPA can boost your earning potential throughout your career. According to the AICPA, CPAs earn 10-15% more than non-CPAs working in accounting-related jobs.

- CPAs have access to jobs with higher authority and responsibility, as well as greater career stability.

- CPAs are the most-trusted advisors to business owners and are known for their high level of integrity and competency.

- Being a CPA allows you to do meaningful work with motivated and talented people.

- You can travel internationally or work right within your local community.

- When you earn your CPA in Florida you become a member of a larger exclusive statewide professional community.

Steps To Becoming A Florida CPA

Cap

Meet Education Requirements

Take 120 semester (or 160 quarter) hour credits.

- 24 semester (or 36 quarter) hours must be in upper-division (junior or senior level) accounting, in areas such as taxation, auditing, financial and cost.

- 24 semester (or 36 quarter) hours must be in upper-division general business, including 3 semester (or 4 quarter) hours in business law.

Schedule Your Exam

- The National Association of State Boards of Accountancy (NASBA) will send you a Notice to Schedule (NTS).

- Use your NTS to schedule your exam at NASBA.

- Pass all 4 parts of the CPA exam during an 18-month time frame. Each section is three-to-four hours.

Gain the Required Work Experience

Obtain one year of work experience.

- Your work experience must be verified by a licensed CPA.

- All requirements to sit for the exam must be met before obtaining your work experience. Board staff calculates the work experience based on when the applicant completed 120 semester hours, regardless of concentration.

Exam

Apply for the Uniform CPA Exam

Apply at the Department of Business and Professional Regulation (DBPR)

- The exam application requires a $50 non-refundable fee.

- Don't forget to submit your transcripts.

- Once the State Board of Accountancy approves your application, it will be sent to NASBA and you will receive a Jurisdiction ID number.

Apply For Licensure

Pass all four parts of the CPA exam and complete 150 semester (225 quarter) credit hours.

- 30 semester (45 quarter) hours must be in upper-division (junior or senior level) accounting such as taxation, auditing, financial and cost.

- 36 semester (54 quarter) hours must be in upper-division business, including 3 semester (4 quarter) hours in business law based on US law.

Apply for your CPA license!

- Apply online at DBPR.

- Include all work experience verifications and academic transcripts.

- You must apply for your license within three years of passing the last part of your CPA exams.

Congratulations, you are now part of a community of more than 18,500 CPAs and accounting professionals!

Newly Certified? Join the FICPA For Half Off!

Congratulations on earning your Florida CPA certification. Join now at 50% off the regular price! The FICPA has opportunities for young CPAs looking to take the next step in their careers. If you have questions about your license and CPE requirements - we're here to help.

Read More-->

Contact Member Services to take advantage of this exclusive offer at 800-342-3197, ext.1 or email [email protected].

You Earned It - Be Recognized!

Newly-Certified Swearing-in Ceremony

Each year the FICPA recognizes all Newly Certified CPAs at a Swearing-in Ceremony held in conjunction with our Mega Conference in Orlando. Meet leaders from the Board of Accountancy and the FICPA and get the recognition you deserve!

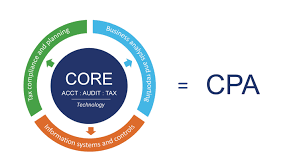

CPA Evolution

Proposed changes will transform the CPA licensure module to recognize the changing skills and competencies accounting requires today.

A combined NASBA /AICPA initiative, the new CPA licensure model proposes a core mastery of accounting, audit, tax, and technology, that all candidates are required to complete. Then, each candidate will choose a discipline in which to demonstrate deeper skills and knowledge.

This model will:

- Enhance public protection by bringing deeper knowledge and skills to the profession.

- Reflects the realities of practice today.

- Is adaptable and flexible.

- Results in one CPA license.

In 2024, the AICPA and NASBA will launch an infrastructure change to the CPA Exam.

CPA Exam Resources

Preparing for the CPA Exam

We're with you every step of the way with discounts on CPA Exam review courses, helping to make sure you've fulfilled the requirements, and one-on-one guidance to help navigate the certification process.

If you're in need more direction or have a question regarding your academics or how to sit for the CPA exam, email [email protected]. We're here to help!

For more information on the CPA career opportunities and the licensure process, check out these resources: