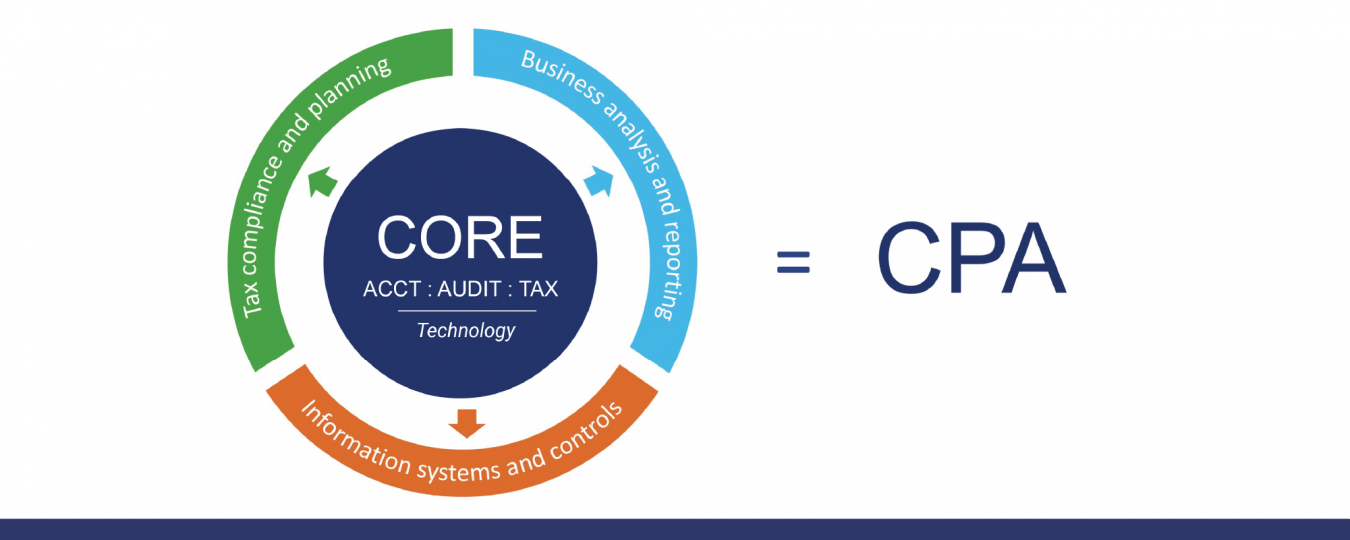

The new CPA Exam is coming our way in 2024, and we have new details to share!

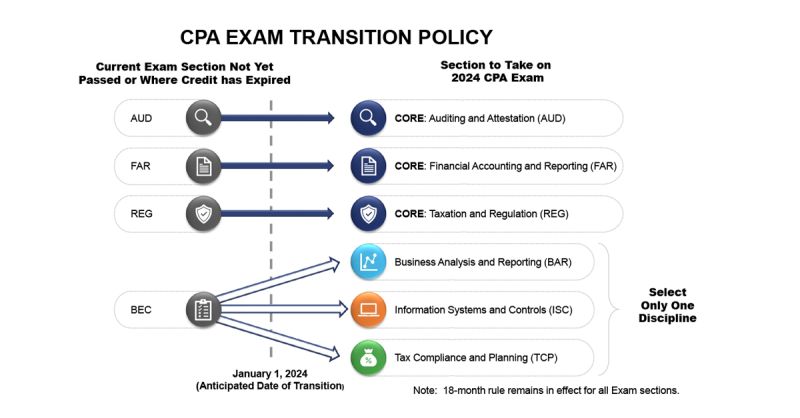

On Friday, NASBA publicized the official transition policy for CPA candidates who have completed one or more but not all four parts of the exam by Dec. 31, 2023.

On Jan. 1, 2024, CPA candidates with outstanding sections to pass will take the new corresponding sections shown below. (Note: The 18-month rule remains in effect for all sections on the current and 2024 CPA Exam.)

Simply put: If you have not passed AUD, FAR or REG on the current CPA Exam, you will need to take the corresponding new core section of AUD, FAR or REG on the 2024 CPA Exam. If you have not passed BEC on the current CPA exam, you will need to take ANY of the three discipline sections. (Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), Tax Compliance and Planning (TCP).

Additional details on the transition and an FAQ guide are linked below.

- Transition Policy Announced for the 2024 CPA Exam Under the CPA Evolution Initiative

- CPA Exam Transition Policy FAQs

The FICPA does not anticipate any licensure changes concerning education or experience for the state of Florida.

Please contact FICPA's Academic & Student Initiatives Manager, Megan Altizer, at [email protected] or at (850) 521-5948 with any additional questions.