Updated Oct. 10

White House Declares Major Disaster

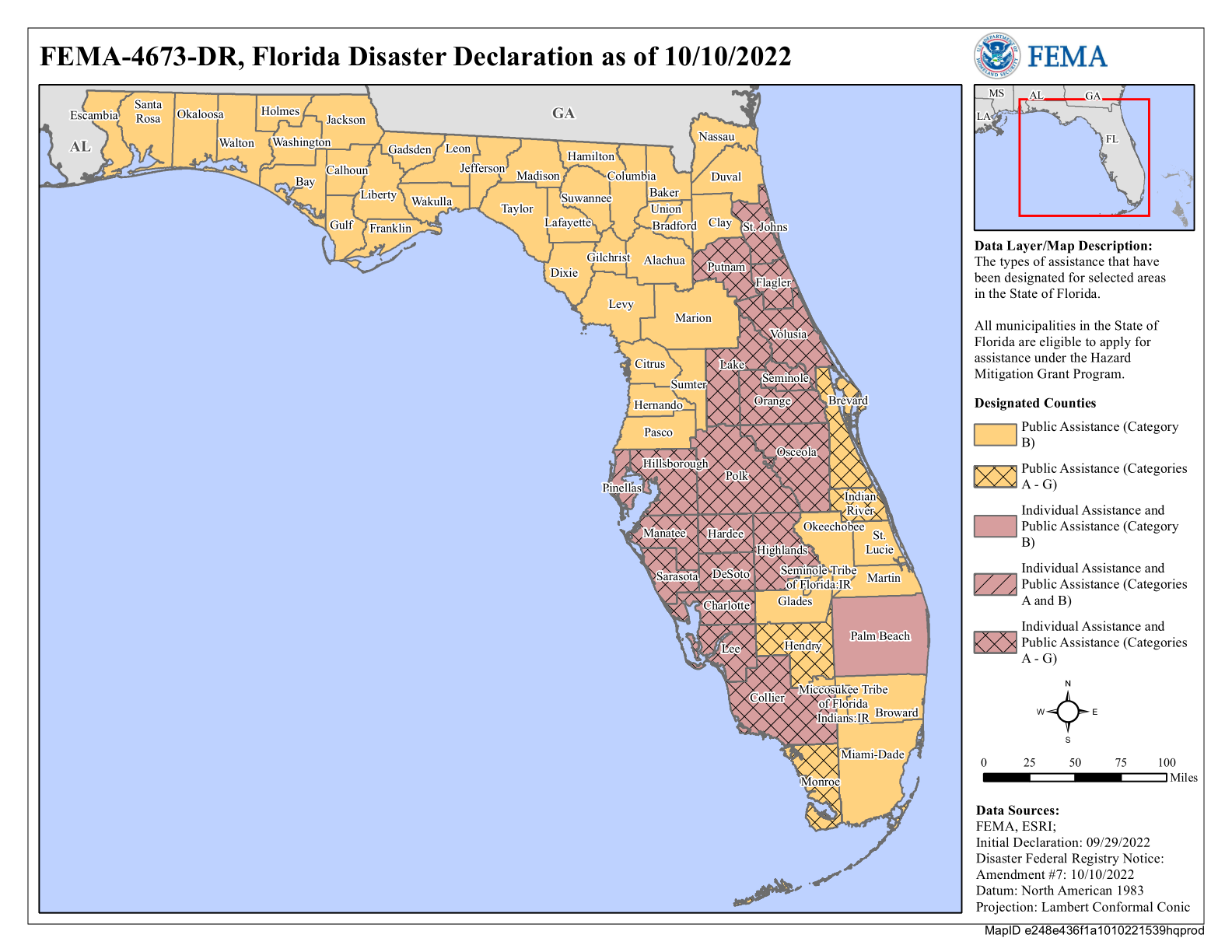

On Thursday, Sept. 29, 2022, the White House declared Hurricane Ian a Major Disaster, which releases additional aid to named counties and automatically extends tax-filing deadlines to the later of the original deadline or 60 days from the declaration date, which is Tuesday, Nov. 22, 2022.

The FICPA is actively advocating for additional relief from both federal and state agencies on behalf of our members. We will continue to provide updated information as it becomes available.

Please direct any questions or correspondence related to the relief efforts to the FICPA Governmental Affairs Department at [email protected].

Tax Filing Deadlines

Tax-filing deadlines are extended for:

- Any individual whose principal residence is located in a disaster area

- Any taxpayer whose principal place of business (other than the business of performing services as an employee) is located in a disaster area

- Any individual who is a relief worker affiliated with a recognized government or philanthropic organization and who is assisting in a disaster area

- Any taxpayer whose records necessary to meet a deadline for an act described in are maintained in a disaster area

- Any individual visiting a disaster area who was killed or injured as a result of the disaster

- Solely with respect to a joint return, any spouse of an individual described in this paragraph.

Here are the laws to reference:

“HR 1865-Further Consolidated Appropriations Act, 2020” added Code Section 7508A(d) to provide a “mandatory 60-day extension” when a “major disaster” is declared. This law is intended to reduce the anxiety to tax practitioners and taxpayers who face filing deadlines as a consequence of events like Hurricane Ian.

In addition, IRS issued SBSE-25-1120-0093 implementing the updating of the Internal Revenue Manual for this legislation. The following are listed in the SBSE Memo by:

- Extending disaster tax relief to counties identified by FEMA as qualifying for Individual and/or Public Assistance under a Major Disaster Declaration.

- Updating the policies and procedures in IRM 25.16.1, Disaster Assistance and Emergency Relief, providing approximately 120 days of disaster relief for both Public and/or Individual Assistance for all federally declared Major Disasters.

- Informing impacted internal/external stakeholders of the new law (Information Technology, Communication and Liaisons, Government Liaison, FEMA, Small Business Association, etc.).

- Issuing any Interim Guidance Memorandums or other alerts as deemed necessary.

- Retroactively providing disaster tax relief to counties identified for Public Assistance under a Major Disaster Declaration since passage of the new legislation.

Revenue Procedure 2018-58 lists the acts covered by a Code Section 7508A delay.

We are continually monitoring the situation and have implemented a special site to keep you updated on the latest developments at https://www.ficpa.org/disaster-relief.

Have a plan and be safe!