Federal Tax Update: At least one couple were not tax people

CPAs in the Spotlight: February 2022

Advocacy Update: FICPA calls for expanded K-2 / K-3 relief

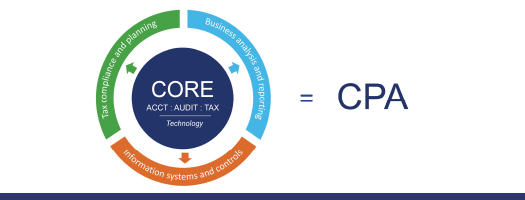

NASBA announces CPA Exam transition policy for 2024

Federal Tax Update: IRS Releases K-2 and K-3 relief

AICPA Town Hall: Feb. 17, 2022

Advocacy Update: IRS issues K-2/K-3 filing relief for 2021

Federal Tax Podcast: IRS suspends issuing more notice types