Internal Revenue Service

Advocacy Update: Legislature passes insurance reform in Special Session

On the heels of the 2022 General Election, the Florida legislature just wrapped its year with a Special Session focused on property insurance.

In this Dec. 16 edition of Advocacy Update, we cover:

- The Florida Legislature's work on insurance reform and toll relief

- Our new Jan. 11 date for Virtual Advocacy Day

- Gov. DeSantis' reappointments to the Board of Accountancy

- Our CPA/PAC's election season success

- And last month's disaster recovery event in Fort Myers

Legislature Wraps Up Special Session

The Florida Legislature on Wednesday wrapped up a special session to address the Florida property insurance crisis.

Lawmakers passed some of the most sweeping changes to the state's property insurance laws in recent history; provided tax and other financial relief for victims of Hurricanes Ian and Nicole; and created a toll credit program to reimburse frequent Florida commuters.

"This Special Session was all about relief,” said Speaker Paul Renner (R-Palm Coast). “I am proud of the work the House did striking a difficult but careful balance to stabilize Florida’s property insurance market and the growth of Citizens Insurance. We have created more competition in the marketplace and have taken significant measures to reduce frivolous lawsuits, all while holding insurers accountable to consumers. The House also took important steps to provide disaster relief to Florida families recovering from Hurricanes Ian and Nicole and designed a toll relief program that saves Florida commuters money.”

Gov. Ron DeSantis signed SB 6A (Toll Relief) into law Thursday.

- Creates a $1 billion reinsurance fund to back up insurance companies,

- Changes coverage eligibility and requirements for Citizens Insurance customers

- Eliminates laws that have allowed "assignment of benefits," a system in which homeowners can sign over their insurance claims to contractors who then work with insurers to get paid

- Eliminates one-way attorney fees

2. Senate Bill 4A:

- Creates tax relief for residential properties rendered uninhabitable for at least 30 days

- Provides $150 million for affordable housing recovery

- Provides $750 million for storm mitigation and recovery efforts

- Provides $350 million to the Public Assistant Program grants program until June 2028

- Creates 12-month toll relief program giving commuters with an electronic prepaid toll program account a 50 percent account credit if they record 35 or more transactions in a month

New Date! Virtual Advocacy Day Moved to Jan. 11

The FICPA's 2023 CPA Advocacy Days are your chance to stand up for the profession and make your voice count!

If you've not yet registered to join us, please note that we have moved Virtual Advocacy Day to Wednesday, Jan. 11, 2023. This new date precedes Florida Legislative Committee Week and will help ensure lawmaker participation.

Our CPA Advocacy Days are annual highlights on the FICPA calendar, and we hope you’ll be able to join us online at our new date and time.

We also encourage you to join us in person, in Tallahassee, on Jan. 25 for our member fly-in event, Hike the Hill.

If you have any questions or concerns, or would like any other information at this time, please email the FICPA Governmental Affairs at [email protected].

We appreciate your participation in the legislative process and we look forward to seeing you online Jan. 11 and in Tallahassee on Jan. 25!

Governor Reappoints Five to Board of Accountancy

On Thursday, Gov. Ron DeSantis announced the reappointment of Michelle Maingot, Steven Platau, William Blend, Shireen Sackreiter and Brent Sparkman to the Florida Board of Accountancy. All are FICPA members.

Maingot is a partner of Ernst & Young LLP. She currently serves on the board of the Tampa Metropolitan Area YMCA and the Junior Achievement of Tampa Bay. Maingot earned her bachelor’s degree in accounting from Florida State University.

Platau is a professor at the University of Tampa. He previously served on the AICPA Joint Trial Board and currently serves as a circuit court mediator certified by the Florida Supreme Court. Platau earned his bachelor’s and master’s degrees from The Ohio State University and his juris doctor from the University of Cincinnati.

Blend is a shareholder with MSL, P.A. He is a veteran of the U.S. Navy and currently serves as a member of the Florida Government Finance Officers Association, the Seminole County Chamber of Commerce and the Seminole State College Advisory Board. Blend earned his bachelor’s degree in accounting from Long Island University.

Sackreiter is the office managing director of Accenture. She is a current member of the Project Management Professionals and is the recipient of the Governor’s Savings Award in 2015. Sackreiter earned her bachelor’s degree in management information systems from Florida State University.

Sparkman is a partner at Carr, Riggs, and Ingram. He is a member of the AICPA and the Association of Certified Fraud Examiners and sits on the board of Ameris Bank. Sparkman earned his bachelor’s degree in accounting and finance from Florida State University.

These appointments are subject to confirmation by the Florida Senate.

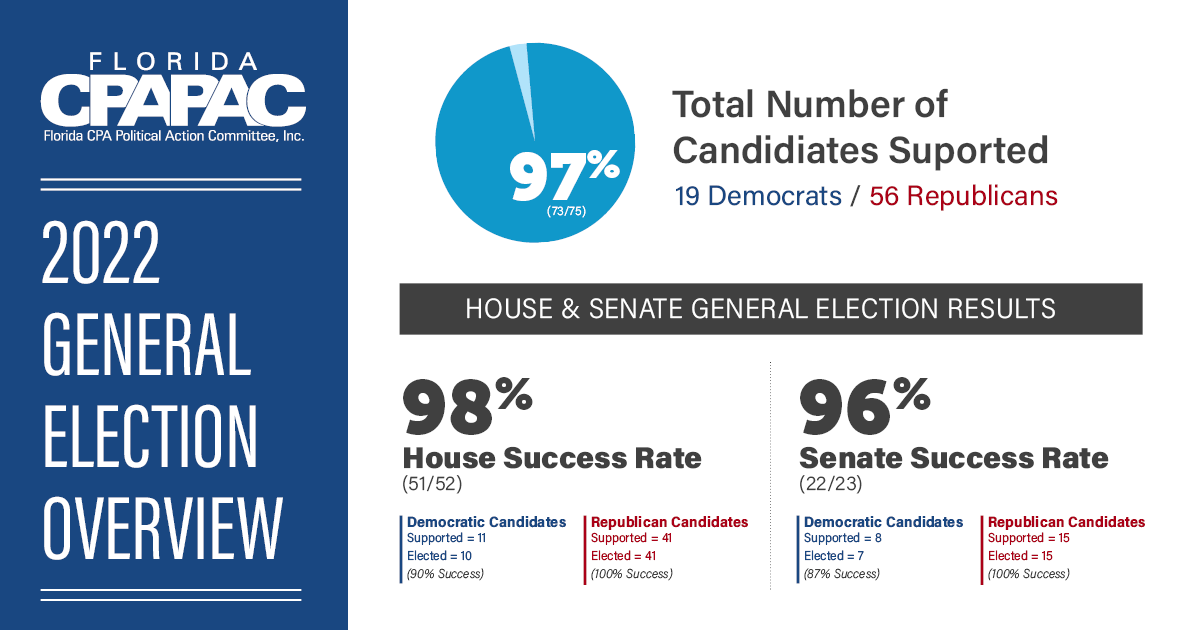

2022 Elections: CPA/PAC Candidates for the Win!

The Florida CPA/PAC is proud to report that, in the Nov. 8 General Election, 97 percent of Florida CPA/PAC-supported candidates – including CPA lawmakers Rep. Mike Caruso, Sen. Joe Gruters and Rep. Cyndi Stevenson – were victorious in their races!

With redistricting unfolding during this election year, the 2022 Election Cycle proved to be particularly challenging. But the CPA profession continues to thrive in Florida, due in no small part to the FICPA members and firms that support the PAC’s advocacy efforts.

We sincerely thank all those who contributed to the PAC this year. Your participation allows the PAC to continue helping elect pro-CPA, pro-business candidates to the Florida Cabinet and Legislature – and educating elected officials about why our profession matters.

Please note: Contributions are strictly voluntary and are not deductible for federal tax purposes. The Florida CPA/PAC is an entity completely separate from the FICPA. The Florida CPA/PAC is supported solely by the voluntary contributions of members of the FICPA and others.

FICPA Holds Disaster Recovery Event in Fort Myers

To continue supporting Florida residents who were affected by Hurricane Ian, the Florida Institute of CPAs (FICPA) held a Disaster Recovery Event on Monday, Nov. 28. The event took place from 10 a.m.-3 p.m. at FICPA member firm Stroemer and Company in Fort Myers

“During the past few weeks, our thoughts and prayers have been our everyone who is recovering from Hurricane Ian,” FICPA President & CEO Shelly Weir said. This time has proven especially challenging as our members assist clients in navigating deadline extensions and casualty and property loss issues, while they address damage and loss of their own. We’ve worked tirelessly to bring filing-deadline relief at the state and national levels, and we hosted this gathering as a way to assist and support further.”

During the event, FICPA leadership and staff were joined by American Institute of CPAs (AICPA) Chair Anoop N. Mehta, CPA, CGMA, as well as representatives of the AICPA Benevolent Fund and the Internal Revenue Service (IRS). The IRS provided important information about storm-related tax-filing deadline extensions and the AICPA Benevolent Fund assisted members with the application process. Lunch was provided and supplies donated through the FICPA Amazon fundraising campaign were distributed.

“Whether our members need support for themselves or guidance on how best to advise their clients, we have them covered,” Weir said, “and we’re supported by a larger network of our state society colleagues. We’re so thankful to the Louisiana State Society, who were on site serving an authentic Cajun meal to attendees, and to our member firm, Stroemer & Company, for hosting this event.”

For more information about the event, and the FICPA’s disaster-recovery efforts on our members’ behalf, visit our online Disaster Relief Hub.

Revenue Ruling 2022-24: Tax Year 2023 Covered Compensation Amount

Revenue Ruling 2022-24 provides covered compensation tables under §401(l)(5)(E) of the Internal Revenue Code, and the Income Tax Regulations thereunder, for the 2023 plan year.

The ruling will be in IRB: 2022-51 on Monday, Dec. 19, 2022.