Internal Revenue Service

Advocacy Update: Legislature passes condo reform in Special Session

The Florida Legislature reconvened this week for its latest Special Session, passing both condominium and property insurance reforms, which have been signed into law by Gov. Ron DeSantis.

In this May 27 edition of Advocacy Update, we address:

- What you need to know about the new condo regulations

- The details of the new property insurance law

- Our recently released, advocacy-focused issue of Florida CPA Today magazine

- The Disaster Preparedness Sales Tax Holiday beginning this Saturday

- IRS FAQ updates for the 2021 Child Tax Credit and Advance Child Tax Credit

- And the latest Department of Revenue TIPs

Latest News

Legislature Adds Condo Reform to Special Session

This week, the Florida Legislature convened in a Special Session to consider legislation related to property insurance, reinsurance, changes to the Florida Building Code to improve the affordability of property insurance, the Office of Insurance Regulation, civil remedies and appropriations.

On Tuesday, the Legislature expanded the scope of the Special Session to include legislation addressing the tragic Surfside Chaplain Towers condominium collapse in June 2021. In the Legislature’s announcement, Florida's future House Speaker, Rep. Danny Perez, expressed his aspirations for the changes adopted this week.

“After I witnessed the tragedy of Surfside, the No. 1 priority for me this past session was to pass meaningful condominium reform,” Rep. Perez said. “I have always been willing to discuss what that looks like, but I was never willing to pass legislation that did not solve the real issue, which is to ensure there is association funding to fix the problems discovered during inspections. I am hopeful, with the commitments from Senate leadership, to pass real reform this Special Session, and in doing so honor the lives lost as well as the survivors and their loved ones.”

The legislation, House Bill 5D, amends Florida’s Building Codes Act, Condominium Act and Cooperative Act to enact new requirements meant to address concerns raised in the aftermath of the collapse. The House Appropriations Committee considered the bill late Tuesday and amended it to the Senate’s roofing bill related to property insurance. The legislation passed both chambers Wednesday and Gov. DeSantis signed it into law Thursday.

Here’s what you need to know about the new law:

1. Requires milestone structural inspections for condominium and cooperative association buildings three stories in height and 30 years old by licensed architect or engineer by Dec. 31, 2024

2. Requires “structural integrity reserve studies” for condominium and cooperative associations at least every 10 years. The following items are required to be included:

- Roof

- Load-bearing walls or other primary structural members

- Floor

- Foundation

- Fireproofing and fire protection systems

- Plumbing

- Electrical systems

- Waterproofing and exterior painting

- Windows

- Any other item that has a deferred maintenance expense or replacement cost that exceeds $10,000 and the failure to replace or maintain such item negatively affects the items listed above as determined by the licensed engineer or architect performing the visual inspection portion of the structural integrity reserve study

3. Effective Dec. 1, 2024, an association or the developer may not waive funding reserves

4. Requires structural integrity reserve studies to be provided to unit owners, developers, buyers and renters

5. Requires condominium and cooperative associations to provide the following information to the Florida Division of Condominiums, Timeshares and Mobile Homes by Jan. 1, 2023:

- The number of buildings in the association that are three stories or higher in height

- The number of units in such buildings

- The address of such buildings

- The counties in which all buildings are located

For more information about the changes, read House Bill 5D and House Analysis of House Bill 5D.

Property Insurance Bills Considered During Session D

In advance of Special Session 2022D, House Speaker Chris Sprowls (R-Clearwater) and Senate President Wilton Simpson (R-Trilby) released memorandums highlighting property insurance legislation that was passed on May 25 and signed into law on May 26.

SB 2D will do the following:

- Create the Reinsurance to Assist Policyholders (RAP) program for insurance companies and allocate $2 billion to the program. The coverage will be at no cost to the insurer and will allow quicker reimbursement for hurricane damages.

- Allocate $150 million for the My Safe Florida Home Program, which will provide funding to residents for hurricane mitigation inspections and grant funding for home hardening upgrades. For every dollar that the homeowner provides, the program will provide $2, allowing homeowners to receive up to $10,000.

- Prohibit contractors from soliciting consumers to make a claim for roof damage unless the solicitation states the consumer must pay the deductible, that a contractor paying or waiving the deductible is a felony and that it is a felony to knowingly file a claim that contains false, misleading or fraudulent information.

- Prohibit insurers from refusing to write or renew a policy on homes with roofs based solely on a roof’s age (less than 15 years old). If a roof is at least 15 years old, insurers must allow the homeowner to have a roof inspection before the homeowner has to replace the roof in order to obtain or renew an insurance policy.

- Limit contingency risk multipliers by allowing attorney fee multipliers in insurance litigation only in specific and rare situations. Eliminate attorney fee awards in assignment of benefits cases and prevent transfers or assignment to collect attorney fees in property insurance litigation.

- Require a policyholder to prove the property insurance company breached its contract before winning a bad faith lawsuit. Require a policyholder to opt out of a separate roof deductible and ensure the roof deductible provision is unambiguous and clear.

- Analyze an insurer’s failure within two months after the insurance company is referred to the Department of Financial Services’ (DFS) Division of Rehabilitation and Liquidation. DFS must review the Office of Insurance Regulation's oversight of the failed insurer.

- Establish an exception to the Florida Building Code to allow roofs that are more than 25 percent damaged but comply with the 2007 Florida Building Code to be repaired instead of mandatory replacement.

- Require insurers to notify a policyholder that they are able to request a copy of an estimate of the loss generated by the insurance adjuster. The insurer must send the estimate to the policyholder within seven days after receiving the request.

Available Now: Florida CPA Today – 2022 Legislative Report

The Spring 2022 Legislative Edition of Florida CPA Today is now available online!

In this advocacy-focused issue, you'll find:

- An in-depth breakdown of Florida's 2022 Legislative Session

- An exclusive Q&A with Florida DBPR Secretary Melanie Griffin

- A recap of our 2022 FICPA Advocacy Days

- Articles on the CPA exam, Florida's 2022 tax package, and changes to the Department of Revenue’s audit process

Click here to enjoy our annual legislative issue!

Disaster Preparedness Sales Tax Holiday and Additional Resources

Earlier this week, the FICPA published a special edition of Advocacy Update focused on disaster preparedness. With hurricane season nearly here, we encourage you to review these resources today to make sure you're ready for every eventuality in the weeks and months to come.

We also want to remind you that, beginning this Saturday, May 28, consumers can purchase qualifying disaster preparedness supplies exempt from tax during the 2022 Disaster Preparedness Sales Tax Holiday.

“Hurricane season can be a trying time but preparing in advance for disasters is the best way to stay safe,” said Jim Zingale, Executive Director of the Florida Department of Revenue (DOR). “The 2022 Disaster Preparedness Sales Tax Holiday helps families stock up on essentials while saving money.”

DOR’s Tax Information Publication (TIP) outlines qualifying items ranging from cans or pouches of wet pet food selling for $2 or less to portable generators selling for $1,000 or less. The sales tax holiday extends through June 10.

IRS Revises 2021 Child Tax Credit and Advance Child Tax Credit

The IRS has issued a Fact Sheet updating the 2021 Child Tax Credit and Advance Child Tax Credit frequently asked questions (FAQs). The updates help eligible families properly claim the credit when they prepare and file their 2021 tax return.

The FAQs revisions are:

- • Topic A: General Information: updated questions 1-5, 8-11, 13- 16

- • Topic E: Advance Payment Process of the Child Tax Credit: updated questions 2-3

- • Topic F: Updating Your Child Tax Credit Information During 2021: removed questions 1-2 and updated 3-4

- • Topic G: Receiving Advance Child Tax Credit Payments: updated questions 1, 6-7, 9-11

- • Topic H: Reconciling Your Advance Child Tax Credit Payments on Your 2021 Tax Return: updated questions 1-2, 9 and removed 10

- • Topic J: Unenrolling from Advance Payments: updated question 1 and removed 2-7

- • Topic K: Verifying Your Identity to View your Payments 2021 Child Tax Credit: Updated 2-3,5-6 and removed 7

- • Topic L: Commonly Asked Shared-Custody Questions: Updated 1-2

Click here to read the full IRS Fact Sheet.

DOR TIPs

The Florida Department of Revenue has published these helpful Tax Information Publications (TIPs) in 2022.

Current Interest Rates

Floating Rate of Interest Remains at 7 Percent for the Period July 1, 2022, Through December 31, 2022

May 4, 2022

The rate of interest for the period July 1, 2022, through December 31, 2022, is 7 percent. The daily interest rate factor to be used for this period is 0.000191781. The daily interest rate is named a factor because it is not expressed as a percentage. This rate is subject to change effective January 1, 2023.

Administration

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit 2022 Legislative Changes

May 11, 2022

Taxpayers with corporate income/franchise taxable years beginning on or after January 1, 2021, may apply to the Florida Department of Revenue (Department) for an allocation of the tax credits available for state fiscal year 2021-2022. The application must be filed by the day before the due date of the Florida Corporate Income/Franchise Tax Return (Form F-1120), or if extended, the day before the extended due date. The Department will send notification of approval or denial of the request for an allocation of the tax credits.

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit for Corporate Income Tax and Insurance Premium Tax

April 28, 2022

Legislation is currently pending that would allow corporate income taxpayers and insurance premium taxpayers to seek a tax credit allocation from the 2021-2022 state fiscal year cap. The Department is accepting applications based on the pending legislation. Allocation approvals are subject to the legislation becoming law.

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit

Feb. 7, 2022

Florida’s New Worlds Reading Initiative was established in 2021 under the Florida Department of Education to improve literacy skills and promote a love of reading by providing high-quality, free books to students in kindergarten through fifth grade who are reading below grade level. Florida’s Strong Families Tax Credit was established in 2021 under the Florida Department of Children and Families to provide services to prevent child abuse, engage absent fathers in being more active in their children’s lives, provide books to eligible children, and assist families of children with chronic illness.

Communications Services Tax

Change in Local Communications Services Tax Rate Beginning May 1, 2022

Jan. 27, 2022

Beginning May 1, 2022, the local communications services tax (CST) rate for the Town of Astatula will change. The total local CST rate includes: (1) the local rate imposed under the CST statute; and (2) any county discretionary sales surtax imposed under the sales and use tax statute.

Corporate Income Tax

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit 2022 Legislative Changes

May 11, 2022

Taxpayers with corporate income/franchise taxable years beginning on or after January 1, 2021, may apply to the Florida Department of Revenue (Department) for an allocation of the tax credits available for state fiscal year 2021-2022. The application must be filed by the day before the due date of the Florida Corporate Income/Franchise Tax Return (Form F-1120), or if extended, the day before the extended due date. The Department will send notification of approval or denial of the request for an allocation of the tax credits.

Florida Corporate Income Tax Adoption of 2022 Internal Revenue Code

May 9, 2022

Each year, the Florida Legislature must consider adopting the current Internal Revenue Code (Title 26, United States Code) to ensure certain tax definitions and the calculation of adjusted federal income will be consistent between the Internal Revenue Code (IRC) and the Florida Income Tax Code (Chapter 220, Florida Statutes [F.S.]). The Florida corporate income tax “piggybacks” federal income tax determinations and uses adjusted federal income as the starting point for computing Florida net income.

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit for Corporate Income Tax and Insurance Premium Tax

April 28, 2022

Legislation is currently pending that would allow corporate income taxpayers and insurance premium taxpayers to seek a tax credit allocation from the 2021-2022 state fiscal year cap. The Department is accepting applications based on the pending legislation. Allocation approvals are subject to the legislation becoming law.

Florida Corporate Income Tax 2022 Automatic Refund

Jan. 13, 2022

An automatic refund is available for Florida corporate income/franchise tax returns filed on or before Feb. 1, 2022, for taxable years beginning on or after April 1, 2019, and on or before March 31, 2020 (subject to any 2022 law change). For most taxpayers, this will be the return for taxable year ending Dec. 31, 2020.

Florida Corporate Income/Franchise Tax – Internship Tax Credit Program

Jan. 4, 2022

For taxable years beginning during the 2022 and 2023 calendar year, a student internship tax credit is available against the Florida corporate income/franchise tax. The Florida Internship Tax Credit Program (Program) allows credit for up to five student interns per taxable year, per corporation. The credit amount is $2,000 per student intern (maximum of $10,000 for each taxable year). A total of $2.5 million in credits are available for each of the two years of the Program.

Gross Receipts Tax

Gross Receipts Tax Index Prices for the Period July 1, 2022 Through June 30, 2023

May 20, 2022

Every year on July 1, the index prices used by distribution companies to calculate the gross receipts tax on the sale or transportation of natural or manufactured gas to retail consumers are adjusted as provided by law. Beginning with customer bills dated on or after July 1, 2022, distribution companies must use the index prices listed below when completing the Gross Receipts Tax Return (Form DR-133).

Insurance Premium Tax

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit 2022 Legislative Changes

May 11, 2022

Taxpayers with corporate income/franchise taxable years beginning on or after January 1, 2021, may apply to the Florida Department of Revenue (Department) for an allocation of the tax credits available for state fiscal year 2021-2022. The application must be filed by the day before the due date of the Florida Corporate Income/Franchise Tax Return (Form F-1120), or if extended, the day before the extended due date. The Department will send notification of approval or denial of the request for an allocation of the tax credits.

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit for Corporate Income Tax and Insurance Premium Tax

April 28, 2022

Legislation is currently pending that would allow corporate income taxpayers and insurance premium taxpayers to seek a tax credit allocation from the 2021-2022 state fiscal year cap. The Department is accepting applications based on the pending legislation. Allocation approvals are subject to the legislation becoming law.

Intangible Tax

2022 Governmental Leasehold Intangible Tax Valuation Factor Table

Jan. 5, 2022

Florida law provides that all leasehold estates or related possessory interest in property of the United States, the State of Florida or any of its political subdivisions, municipalities, agencies, authorities or other governmental units are taxed as intangible personal property if the leased property is undeveloped or predominantly used for a residential or commercial purpose and rental payments are due in consideration of the leasehold estate or possessory interest. Unless the leasehold estate qualifies for specific exemptions, lessees of governmentally owned property are required to file an annual intangible tax return.

Sales and Use Tax

State Sales Tax Rate Imposed on Retail Sales of New Mobile Homes Reduced to 3%

May 27, 2022

Beginning July 1, 2022, the state sales tax rate imposed on the retail sale of a new mobile home is reduced from 6% to 3%. Any applicable discretionary sales surtax (local option sales tax) continues to apply.

Tax-Exempt Admissions Expanded

May 24, 2022

Effective July 1, 2022, admissions to certain FIFA World Cup matches, Formula One Grand Prix races and Daytona 500 races are exempt from sales tax.

2022 Sales Tax Exemption Period on Children’s Books – May 14, 2022, Through August 14, 2022

May 6, 2022

Florida’s first sales tax exemption period on children’s books begins Saturday, May 14, 2022, and ends Sunday, August 14, 2022. During the sales tax exemption period, tax is not due on the retail sale of children’s books.

2022 Disaster Preparedness Sales Tax Holiday May 28, 2022, Through June 10, 2022

May 6, 2022

The 2022 Disaster Preparedness Sales Tax Holiday begins on Saturday, May 28, 2022, and ends on Friday, June 10, 2022. During the sales tax holiday period, tax is not due on the retail sale of eligible items related to disaster preparedness.

Freedom Week Sales Tax Holiday on Specific Admissions and Outdoor Activity Supplies July 1, 2022, Through July 7, 2022

May 6, 2022

The sales tax holiday begins on Friday, July 1, 2022, and ends on Thursday, July 7, 2022. During this sales tax holiday period, tax is not due on the retail sale of admissions to music events, sporting events, cultural events, specified performances, movies, museums, state parks, and fitness facilities. Also exempt from sales tax during this holiday period are eligible boating and water activity supplies, camping supplies, fishing supplies, general outdoor supplies, residential pool supplies and sporting equipment.

Sales Tax Exemption Period on New ENERGY STAR Appliances – July 1, 2022, Through June 30, 2023

May 6, 2022

Florida’s sales tax exemption period on new ENERGY STAR appliances for noncommercial use begins Friday, July 1, 2022, and ends Friday, June 30, 2023. During this sales tax exemption period, tax is not due on the retail sale of eligible new ENERGY STAR appliances purchased for noncommercial use. The rental of eligible new ENERGY STAR appliances does not qualify for the exemption.

Sales Tax Exemption Period on Children's Diapers and Baby and Toddler Clothing, Apparel and Shoes – July 1, 2022, Through June 30, 2023

May 6, 2022

Florida’s first sales tax exemption period on children’s diapers and baby and toddler clothing, apparel, and shoes begins Friday, July 1, 2022, and ends Friday, June 30, 2023. During this sales tax exemption period, tax is not due on the retail sale of children’s diapers or on baby and toddler clothing, apparel, and shoes primarily intended for children age 5 or younger

Sales Tax Exemption Period on Impact-Resistant Doors, Garage Doors, and Windows – July 1, 2022, Through June 30, 2024

May 6, 2022

A temporary sales tax exemption period on impact-resistant doors, impact-resistant garage doors, and impact-resistant windows begins July 1, 2022, and ends June 30, 2024. During this sales tax exemption period, tax is not due on the retail sales of impact-resistant doors, impact-resistant garage doors, and impact-resistant windows for commercial or noncommercial use.

2022 Back-to-School Sales Tax Holiday – July 25, 2022, Through August 7, 2022

May 6, 2022

During the sales tax holiday period, tax is not due on the retail sale of:

- Clothing, footwear, and certain accessories with a sales price of $100 or less per item*

- Certain school supplies with a sales price of $50 or less per item,

- Learning aids and jigsaw puzzles with a sales price of $30 or less*

- Personal computers and certain computer-related accessories with a sales price of $1,500 or less, when purchased for noncommercial home or personal use

- Read the full TIP here.

2022 Sales Tax Holiday for Tools Commonly Used by Skilled Trade Workers – September 3, 2022, Through September 9, 2022

May 6, 2022

Florida’s 2022 ‘Tool Time’ Sales Tax Holiday begins on Saturday, September 3, 2022, and ends on Friday, September 9, 2022. During this sales tax holiday period, tax is not due on the retail sale of eligible items related to tools commonly used by skilled trade workers.

Madison County Increases Its Tourist Development Tax Rate From 3% to 5%

Jan. 5, 2022

The Madison County Board of County Commissioners adopted Ordinance No. 2021-246 increasing the tourist development tax rate from 3% to 5% on transient rental transactions occurring in Madison County.

Severance Tax

Gas and Sulfur Production Tax Rates for 2022-2023

May 10, 2022

On July 1 of each year, the tax rates for production of gas and sulfur are adjusted as provided by law. The adjusted rates must be used when completing the Declaration of Estimated Gas and Sulfur Production Tax (Form DR-144ES) beginning with the July 2022 estimated payment. Form DR-144ES will be mailed to all active accounts during the last week of July.

Solid Mineral Tax Rates for 2022

March 21, 2022

Phosphate rock producers are subject to tax as provided by law. Use the following rate when completing the Declaration/Installment Payment of Estimated Solid Mineral Severance Tax (Form DR-142ES).

Contribute

The Florida CPA/PAC supports the politicians who stand up for CPAs. We back the candidates and incumbents who will ensure CPAs and their clients are included in the legislative process. It is your voluntary contributions that help protect the CPA license.

Please note: Contributions are strictly voluntary and are not deductible for federal tax purposes. The Florida CPA/PAC is an entity completely separate from the FICPA. The Florida CPA/PAC is supported solely by the voluntary contributions of members of the FICPA and others.

Advocacy Update: Special Session to convene next week

With a Special Session set for next week in Tallahassee, the FICPA Governmental Affairs Team has the latest news impacting the CPA profession at the state and federal levels.

In our April 15, 2022, edition of Advocacy Update, we address:

- Next week's Special Session focused on redistricting

- Florida's new financial literacy law and why it matters

- FICPA's upcoming Town Hall recapping the 2022 Legislative Session

- OMB's recent Single Audit Update for COVID funds

- Upcoming scholarship deadlines (including today's April 15 cutoff)

- And the latest Department of Revenue TIPs

Latest News

Special Session set for April 19-22

Gov. Ron DeSantis on March 29 called a Special Session of the Florida Legislature to produce a new map establishing lawful congressional voting districts in Florida. The governor vetoed CS/SB 102 after reviewing the bill, citing legal concerns.

The Special Session will convene at noon on Tuesday, April 19 and will extend no later than 11:59 p.m. on Friday, April 22.

“We have a responsibility to produce maps for our citizens that do not contain unconstitutional racial gerrymanders,” Gov. DeSantis said. “Today, I vetoed a map that violates the U.S. Constitution, but that does not absolve the Legislature from doing its job. I appreciate the Legislature’s willingness to work with me to pass a legally compliant map this Special Session.”

Read a supporting memorandum here, the full veto transmittal letter here and proclamation calling for the Special Session here.

Governor Signs Financial Literacy Bill

In March, Gov. Ron DeSantis signed Senate Bill 1054, requiring financial-literacy instruction in Florida public schools. The bill is cited as the Dorothy L. Hukill Financial Literacy Act in honor of the late Sen. Hukill, who was a strong supporter of the CPA profession. It requires all students, starting with those who begin high school in the 2023-2024 school year, to take a half-credit financial literacy class before graduating.

For many years, the FICPA supported Sen. Hukill’s efforts to boost financial literacy among students throughout Florida. We thank Sen. Travis Hutson and Rep. Demi Busatta Cabrera for sponsoring the legislation and Gov. Ron DeSantis for signing the bill into law, bringing Sen. Hukill’s efforts to fruition.

In honor of Financial Literacy Month, the latest edition of FICPA Conversations features a leading champion for financial literacy: Stuart Rohatiner. A longtime FICPA member and a partner at Gerson, Preston, Klein, Lips, Eisenberg & Gelber, P.A. in Miami, Rohatiner also is a financial counselor at the Overtown Youth Center, which provides an array of services and opportunities to at-risk youth in South Florida.

We talked to Stuart about his passion for financial literacy and why early education is so vital for future success.

FICPA Town Hall to Recap 2022 Legislative Session

Join our FICPA Town Hall at 11 a.m. on April 21 for an in-depth recap of the 2022 Florida Legislative Session. As part of our ongoing mission to inform members about the issues impacting Florida businesses and the CPA profession, we’ll bring you the most up-to-date public policy and political information from Tallahassee. This session is free for FICPA members.

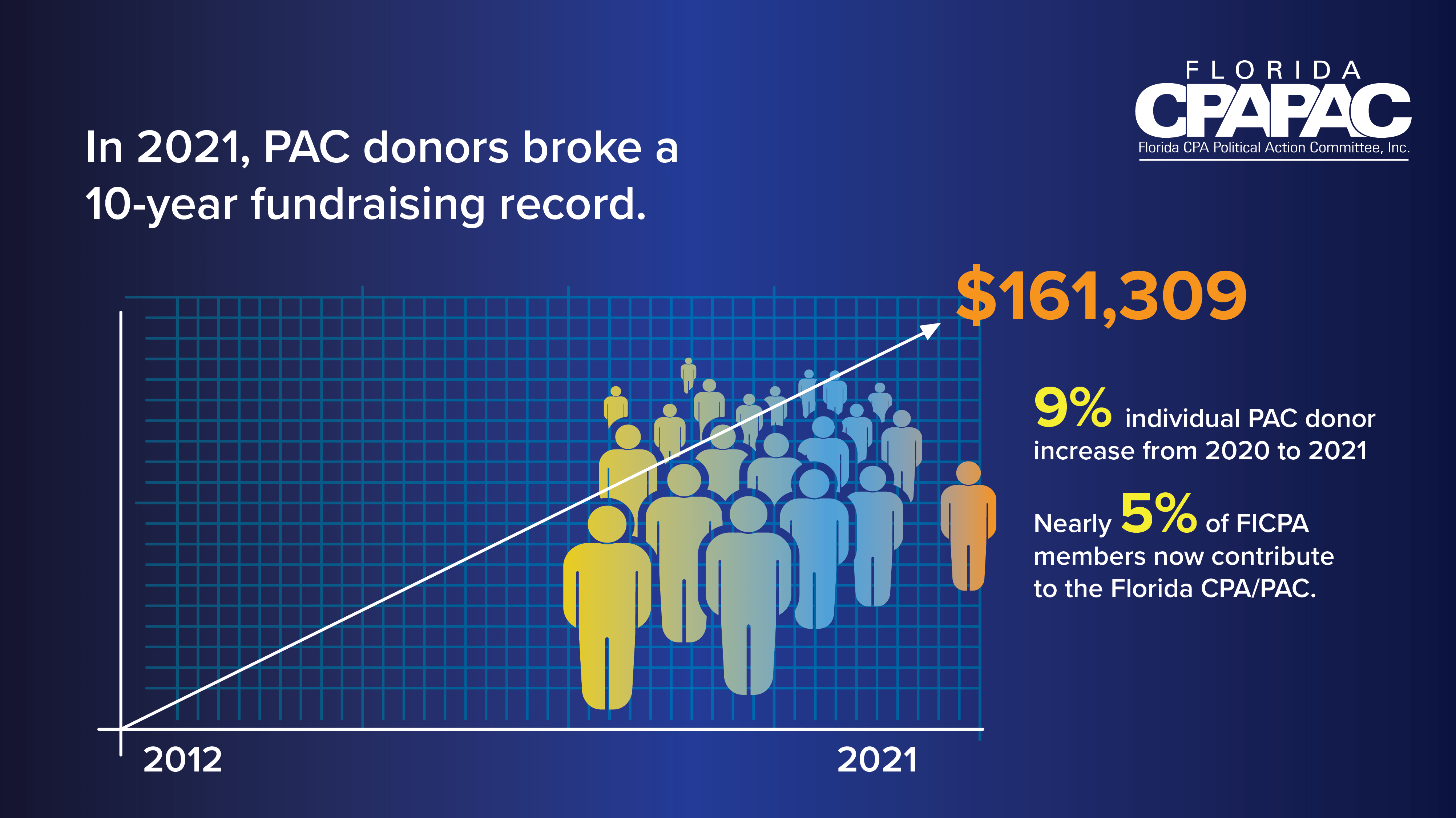

PAC Donors Break 10-year Fundraising Record

In 2021, the Florida CPA/PAC raised over $160,000 – representing the highest donation level since 2012 and a 9% increase in individual PAC donors from 2020.

Of the candidates we supported during the last election year, 98% were elected to state office – and we’ve worked nonstop to make sure they know the issues impacting you and your practice. But our work isn’t done.

During the upcoming Special Session, the state of Florida will undergo redistricting – the redrawing of congressional and state legislative boundaries. This process will reshape Florida’s political landscape this November, when all 120 Florida House and 40 Senate seats – as well as the entire Cabinet – will be on the ballot.

The district changes, and the outcomes of this election year, can impact the laws and regulations governing the CPA profession throughout the state. Now is the time to do your part.

Please consider joining your colleagues who support our advocacy efforts on behalf of the CPA profession.

Look for a member-exclusive “2022 Election Update” from the FICPA Governmental Affairs team this October.

Spring FCT Highlights 2022 Session Wins

Don’t miss the Spring Legislative Issue of Florida CPA Today magazine, highlighting victories on behalf of the CPA profession during the 2022 Legislative Session.

This issue will include a recap of this year’s Virtual Advocacy and Hike the Hill events, a profile on DBPR Secretary Melanie Griffin, and more.

Look for the Legislative Issue in your mailbox – and email inbox – in May!

OMB Issues Update to Single Audit 2021 Compliance Supplement

The Office of Management and Budget (OMB) released a technical update to language in the 2021 Compliance Supplement affecting two key COVID-19 relief programs last Friday. The two programs are the Department of Health and Human Services Assistance Listing 93.498 Provider Relief Fund and Treasury Assistance Listing 21.027 Coronavirus State and Local Fiscal Recovery Funds (SLFRF). The amendment is applicable only for fiscal year audits beginning after June 30, 2020.

Notably, the update provides an alternative audit approach for eligible SLFRF recipients “that would otherwise not be required to undergo an audit if it was not for the expenditures of SLFRF funds directly awarded by Treasury.” For eligible SLFRF recipients, the OMB has authorized the use of an Alternative Compliance Examination Engagement in lieu of a full single audit or program-specific audit.

The requirements for the Alternative Compliance Examination Engagement are outlined here: Treasury Assistance Listing 21.027-9

Additional instructions for where and how to submit the results of the alternative compliance examination engagement will be forthcoming and posted to the Coronavirus State and Local Fiscal Recovery Funds’ website.

IRS Commissioner to Senators: ‘Our Efforts Are Working’

IRS Commissioner Charles Rettig updated members of the Senate Finance Committee last week on the Service's performance in the soon-to-be-concluded tax filing season, as well as longer-term assessments of its efforts to modernize its operations, fill staffing gaps and improve taxpayer service and enforcement.

"Our efforts are working; we're trending in the right direction," Rettig said in response to a question from Sen. Pat Toomey, R-PA, about reducing the backlog and improving the level of service on the IRS' toll-free phone lines.

The FICPA, AICPA and other practitioner groups continue to advocate for additional IRS actions to provide much-needed relief to taxpayers and practitioners.

NTA Calls for More Time to Contest Denial of Refund or Credit Claim

National Taxpayer Advocate (NTA) Erin Collins recommended the IRS temporarily postpone the two-year time limit for taxpayers to file a lawsuit to contest the Service's disallowance of a claim for refund or credit, and allow more time to resolve such disputes administratively with the IRS. Collins included the recommendation in her NTA Blog entry last week, which also warned taxpayers and their representatives the time limit applies regardless of whether a taxpayer is pursuing an administrative appeal.

BOA Accepting Clay Ford Scholarship Applications

The Florida Board of Accountancy (BOA) is now accepting applications for the Clay Ford Scholarship. The scholarship was established to provide financial assistance to minority students as they pursue the fifth year of education required to become a licensed CPA. The scholarships are funded by a portion of each individual and CPA firm license fee.

Through the award, scholarship applicants may be awarded up to $6,000 per semester for a maximum of two semesters. Each year, the FICPA advocates for inclusion of the funding authority in the state’s budget. This year’s application deadline is set for Wednesday, June 1.

In 1998, after four years of discussion, the Florida Legislature recognized the need to assist minority accounting students in completing the fifth year of education required to become a licensed CPA. Through the leadership of former BOA Chair Shaun Davis, CPA and former FICPA President Ron Thompkins, CPA, the FICPA and the BOA partnered to seek legislation that ultimately created the Minority Scholarship Program.

In 2013, the Florida Legislature posthumously renamed the program after Rep. Clay Ford, a strong advocate for the program and the CPA profession. Clay Ford scholarships are administered through the CPA Education Minority Assistance Advisory Council, which was created in 1999 to encourage minorities to enter the CPA profession. The scholarships are awarded on a combination of criteria related to financial need and scholastic ability and performance.

For more information or to apply, visit the Florida Department of Business and Professional Regulation website.

April 15 Deadline: Apply for an FICPA Scholarship Today!

Are you a student member looking for help with tuition? Or are you an FICPA member who knows an accounting student in need of financial support? Fourth- and fifth-year accounting students are eligible to apply for an FICPA scholarship of up to $5,000 in funding.

Be sure to apply now – the application deadline ends today!

DOR TIPs

The Florida Department of Revenue has published these helpful Tax Information Publications (TIPs) in 2022.

Administration

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit

Feb. 7, 2022

Florida’s New Worlds Reading Initiative was established in 2021 under the Florida Department of Education to improve literacy skills and promote a love of reading by providing high-quality, free books to students in kindergarten through fifth grade who are reading below grade level. Florida’s Strong Families Tax Credit was established in 2021 under the Florida Department of Children and Families to provide services to prevent child abuse, engage absent fathers in being more active in their children’s lives, provide books to eligible children, and assist families of children with chronic illness.

Communications Services Tax

Change in Local Communications Services Tax Rate Beginning May 1, 2022

Jan. 27, 2022

Beginning May 1, 2022, the local communications services tax (CST) rate for the Town of Astatula will change. The total local CST rate includes: (1) the local rate imposed under the CST statute; and (2) any county discretionary sales surtax imposed under the sales and use tax statute.

Corporate Income Tax

Florida Corporate Income Tax 2022 Automatic Refund

Jan. 13, 2022

An automatic refund is available for Florida corporate income/franchise tax returns filed on or before Feb. 1, 2022, for taxable years beginning on or after April 1, 2019, and on or before March 31, 2020 (subject to any 2022 law change). For most taxpayers, this will be the return for taxable year ending Dec. 31, 2020.

Florida Corporate Income/Franchise Tax – Internship Tax Credit Program

Jan. 4, 2022

For taxable years beginning during the 2022 and 2023 calendar year, a student internship tax credit is available against the Florida corporate income/franchise tax. The Florida Internship Tax Credit Program (Program) allows credit for up to five student interns per taxable year, per corporation. The credit amount is $2,000 per student intern (maximum of $10,000 for each taxable year). A total of $2.5 million in credits are available for each of the two years of the Program.

Intangible Tax

2022 Governmental Leasehold Intangible Tax Valuation Factor Table

Jan. 5, 2022

Florida law provides that all leasehold estates or related possessory interest in property of the United States, the State of Florida or any of its political subdivisions, municipalities, agencies, authorities or other governmental units are taxed as intangible personal property if the leased property is undeveloped or predominantly used for a residential or commercial purpose and rental payments are due in consideration of the leasehold estate or possessory interest. Unless the leasehold estate qualifies for specific exemptions, lessees of governmentally owned property are required to file an annual intangible tax return.

Sales and Use Tax

Madison County Increases Its Tourist Development Tax Rate From 3% to 5%

Jan. 5, 2022

The Madison County Board of County Commissioners adopted Ordinance No. 2021-246 increasing the tourist development tax rate from 3% to 5% on transient rental transactions occurring in Madison County.

Solid Mineral Tax Rates for 2022

March 21, 2022

Phosphate rock producers are subject to tax as provided by law. Use the following rate when completing the Declaration/Installment Payment of Estimated Solid Mineral Severance Tax (Form DR-142ES).

Contribute

The Florida CPA/PAC supports the politicians who stand up for CPAs. We back the candidates and incumbents who will ensure CPAs and their clients are included in the legislative process. It is your voluntary contributions that help protect the CPA license.

Please note: Contributions are strictly voluntary and are not deductible for federal tax purposes. The Florida CPA/PAC is an entity completely separate from the FICPA. The Florida CPA/PAC is supported solely by the voluntary contributions of members of the FICPA and others.

Advocacy Update: FICPA urges Sens. Rubio, Scott to sign letter to IRS

With the Florida Legislative Session set to conclude on Monday, the FICPA Governmental Affairs team is here to get you caught up on the latest news and notes impacting the profession.

In our March 11, 2022, edition of Advocacy Update, we address:

- A bipartisan letter urging the IRS to suspend additional taxpayer notices

- Our CEO Conversation recapping the 2022 Legislative Session

- The IRS' face-to-face assistance this Saturday (March 12)

- The BOA's Clay Ford Scholarship for minority accounting students

- The status of key legislation in Tallahassee

- And the latest Department of Revenue TIPs

Latest News

FICPA Urges Senators Rubio and Scott to Sign Letter to IRS Commissioner

The FICPA on Tuesday reached out to Florida’s U.S. Senators – Marco Rubio and Rick Scott – asking them to sign a letter addressed to IRS Commissioner Charles Rettig. Sens. Bill Cassidy (R-LA) and Bob Menendez (D-NJ) are circulating the bipartisan letter, which asks the IRS for more information about what – and what additional authority, if any – it needs to suspend sending additional notices to taxpayers.

The profession – the AICPA, state CPA societies and other professional organizations – has been calling on the IRS for many months to suspend various taxpayer notices. Temporarily suspending notices, which are piling up on taxpayers and their practitioners this filing season, should help reduce contact with the beleaguered IRS and ease some taxpayer confusion. However, the IRS has repeatedly suggested it does not have the authority to suspend all automated notices and has continued sending notices to taxpayers, causing confusion, anxiety and significant wasted time for tax preparers and their clients.

Clarifying where the IRS may need Congressional assistance to suspend certain notices will help federal lawmakers as they work to blunt the impact of the backlog on individual and business taxpayers.

FICPA CEO Conversations: Recapping the Florida Legislative Session

In the latest edition of FICPA CEO Conversations, FICPA President & CEO Shelly Weir, Liberty Partners of Tallahassee President Jennifer Green, and I recap the 2022 Florida Legislative Session.

We've been hard at work these last 60 days, representing the interests of Florida's CPAs and advocating on behalf of the profession.

As the 2022 Session comes to a close, this edition of CEO Conversations highlights the issues the FICPA has been engaged in on your behalf. Highlights include:

- A recap of the major policy issues the Legislature considered, including several impacting CPAs

- An overview of the Department of Revenue’s (DOR) Tax Administration bill

- An update on Condo and Homeowners Associations changes

- The status of the state’s budget and highlights for the profession

Click on the player above for the full conversation.

IRS Offers Face-to-Face Help This Saturday

This week, the IRS announced Taxpayer Assistance Centers (TACs) will be open this Saturday, March 12, to assist taxpayers with this year’s filing season questions.

You may read the IRS news release here.

The TACs in Fort Myers, Maitland/Orlando, Plantation/Fort Lauderdale and Miami will be open from 9 a.m. to 4 p.m. with no appointment required. Normally, TACs are open only on weekdays.

“We know that many taxpayers work during the week or have other obligations that make it difficult to get away to take care of their taxes during our routine business hours,” IRS Wage and Investment Division Commissioner and Taxpayer Experience Officer Ken Corbin said in the announcement. “We’re here to help, and people don’t need an appointment during these special Saturday hours.”

For more information about the TACs, visit the IRS website.

BOA Accepting Clay Ford Scholarship Applications

The Florida Board of Accountancy is now accepting applications for the Clay Ford Scholarship. The scholarship was established to provide financial assistance to minority students as they pursue the fifth year of education required to become a licensed CPA. The scholarships are funded by a portion of each individual and CPA firm license fee.

Through the award, scholarship applicants may be awarded up to $6,000 per semester for a maximum of two semesters. Each year, the FICPA advocates for inclusion of the funding authority in the state’s budget. This year’s application deadline is set for Wednesday, June 1.

In 1998, after four years of discussion, the Florida Legislature recognized the need to assist minority accounting students in completing the fifth year of education required to become a licensed CPA. Through the leadership of former Florida Board of Accountancy (BOA) Chair Shaun Davis, CPA, and former FICPA President Ron Thompkins, CPA, the FICPA and the BOA partnered to seek legislation that ultimately created the Minority Scholarship Program.

In 2013, the Florida Legislature posthumously renamed the program after Rep. Clay Ford, a strong advocate for the program and the CPA profession. Clay Ford scholarships are administered through the CPA Education Minority Assistance Advisory Council, which was created in 1999 to encourage minorities to enter the CPA profession. The scholarships are awarded on a combination of criteria related to financial need and scholastic ability and performance.

For more information or to apply, visit the Florida Department of Business and Professional Regulation website.

2022 Bill Tracker

HB 7071: Taxation by Rep. Bobby Payne (co-introducers Reps. Robin Bartleman, Kamia Brown, Daisy Morales, Toby Overdorf and Marie Paule Woodson)

Referred to Appropriations

Provides specified tax exemptions for specified industries and products; provides tax credits for specified businesses; provides refunds of previously paid taxes for specified purposes; provides abatement of taxes paid for specified purposes; provides sales tax holidays for specified items.

Effective date: July 1, 2022

Status: Placed in conference (Appropriations Conference Committee/Appropriations)

SB 1090: Corporate Income Tax by Sen. Joe Gruters

Referred to Finance and Tax; Appropriations

Adopts the 2022 version of the Internal Revenue Code for purposes of the state corporate income tax code; revises the timeframe during which the adjustment of the corporate tax rate based on net collections exceeding adjusted forecasted collections applies; provides for retroactive operation; provides applicability for adjustments taxpayers must make to adjusted federal income with respect to bonus depreciation, etc.

Effective Date: Upon becoming a law.

Status: In appropriations

SB 1382: Tax Administration by Sen. Joe Gruters

Referred to Community Affairs; Finance and Tax; Appropriations

Prohibits taxpayers from submitting certain records in tax proceedings under certain circumstances; authorizes the Department of Revenue to respond to contact initiated by taxpayers to discuss audits; clarifies conditions for application of an exemption for sales taxes for certain nonresident purchasers of boats or aircraft; deletes a tax exemption for building materials used in the rehabilitation of real property located in an enterprise zone; revises the period in which, and conditions under which, the executive director of the department may adopt emergency rules; excludes certain benefit charges from the employer reemployment assistance contribution rate calculation, etc.

Effective Date: July 1, 2022

Status: Senate - ordered enrolled

SB 1276: Legislative Review of Proposed Regulation of Unregulated Functions by Sen. Manny Diaz

Referred to Regulated Industries; Governmental Oversight and Accountability; Rules

Provides that certain requirements must be met before adopting the regulation of an unregulated profession or occupation or the substantial expansion of regulation of a regulated profession or occupation; requires the proponents of legislation that proposes such regulation to provide certain information to the state agency that would have jurisdiction over the proposed regulation and to the Legislature by a certain date; requires such state agency to provide certain information to the Legislature within a specified timeframe; provides an exception, etc.

Effective Date: July 1, 2022

Status: Introduced

SB 1302: Criminal History Records by Sen. Danny Burgess

Referred to Regulated Industries; Appropriations Subcommittee on Criminal and Civil Justice; Appropriations

Prohibits an applicable board, or the Department of Business and Professional Regulation if there is no such board, from inquiring into or considering the conviction history of an applicant for licensure until it is determined that the applicant is otherwise qualified; prohibiting the applicable board, or the department if there is no board, from denying an application for licensure of a person based solely or in part on an applicant’s criminal history; provides requirements for determining if such criminal history directly relates to the practice of the applicable profession; provides requirements for court-ordered sealing of certain records that were automatically sealed by the Department of Law Enforcement under specified provisions, etc.

Effective Date: July 1, 2022

Status: Favorable by Appropriations Subcommittee on Criminal and Civil Justice - YEAS 7, NAYS 0

In Appropriations

To view more legislation the FICPA is tracking during the 2022 Legislative Session, log in to your member account and visit our Advocacy Action Center.

DOR TIPs

The Florida Department of Revenue has published these helpful Tax Information Publications (TIPs) in 2022.

Administration

New Worlds Reading Initiative Tax Credit and Strong Families Tax Credit

Feb. 7, 2022

Florida’s New Worlds Reading Initiative was established in 2021 under the Florida Department of Education to improve literacy skills and promote a love of reading by providing high-quality, free books to students in kindergarten through fifth grade who are reading below grade level. Florida’s Strong Families Tax Credit was established in 2021 under the Florida Department of Children and Families to provide services to prevent child abuse, engage absent fathers in being more active in their children’s lives, provide books to eligible children, and assist families of children with chronic illness.

Communications Services Tax

Change in Local Communications Services Tax Rate Beginning May 1, 2022

Jan. 27, 2022

Beginning May 1, 2022, the local communications services tax (CST) rate for the Town of Astatula will change. The total local CST rate includes: (1) the local rate imposed under the CST statute; and (2) any county discretionary sales surtax imposed under the sales and use tax statute.

Corporate Income Tax

Florida Corporate Income Tax 2022 Automatic Refund

Jan. 13, 2022

An automatic refund is available for Florida corporate income/franchise tax returns filed on or before Feb. 1, 2022, for taxable years beginning on or after April 1, 2019, and on or before March 31, 2020 (subject to any 2022 law change). For most taxpayers, this will be the return for taxable year ending Dec. 31, 2020.

Florida Corporate Income/Franchise Tax – Internship Tax Credit Program

Jan. 4, 2022

For taxable years beginning during the 2022 and 2023 calendar year, a student internship tax credit is available against the Florida corporate income/franchise tax. The Florida Internship Tax Credit Program (Program) allows credit for up to five student interns per taxable year, per corporation. The credit amount is $2,000 per student intern (maximum of $10,000 for each taxable year). A total of $2.5 million in credits are available for each of the two years of the Program.

Intangible Tax

2022 Governmental Leasehold Intangible Tax Valuation Factor Table

Jan. 5, 2022

Florida law provides that all leasehold estates or related possessory interest in property of the United States, the State of Florida or any of its political subdivisions, municipalities, agencies, authorities or other governmental units are taxed as intangible personal property if the leased property is undeveloped or predominantly used for a residential or commercial purpose and rental payments are due in consideration of the leasehold estate or possessory interest. Unless the leasehold estate qualifies for specific exemptions, lessees of governmentally owned property are required to file an annual intangible tax return.

Sales and Use Tax

Madison County Increases Its Tourist Development Tax Rate From 3% to 5%

Jan. 5, 2022

The Madison County Board of County Commissioners adopted Ordinance No. 2021-246 increasing the tourist development tax rate from 3% to 5% on transient rental transactions occurring in Madison County.

Contribute

The Florida CPA/PAC supports the politicians who stand up for CPAs. We back the candidates and incumbents who will ensure CPAs and their clients are included in the legislative process. It is your voluntary contributions that help protect the CPA license.

Please note: Contributions are strictly voluntary and are not deductible for federal tax purposes. The Florida CPA/PAC is an entity completely separate from the FICPA. The Florida CPA/PAC is supported solely by the voluntary contributions of members of the FICPA and others.