Updated 4 p.m. ET

Since Hurricane Idalia hit Florida on Aug. 30, the FICPA has been advocating for its members and their clients, requesting all available relief at the state and federal levels.

In the latest edition of Advocacy Update, you'll find breaking news from the Florida Department of Revenue and the U.S. Treasury's Financial Crimes Enforcement Network, granting tax and reporting relief for those impacted by Hurricane Idalia.

You'll also find for news and notes on:

- Our success in securing expanded tax relief from the IRS

- New executive orders from DBPR in response to Idalia

- The activation of Florida's Small Business Emergency Bridge Loan Program

- Our preparation for Florida's 2024 Legislative Session

- A letter-writing campaign aimed at securing a BOI reporting delay

- And how to join our Key Person Contact program

FinCEN Grants FBAR Relief

The Financial Crimes Enforcement Network (FinCEN) on Friday issued a notice extending the filing date of Reports of Foreign Bank and Financial Account (FBARs) for victims of recent natural disasters, including Hurricane Idalia.

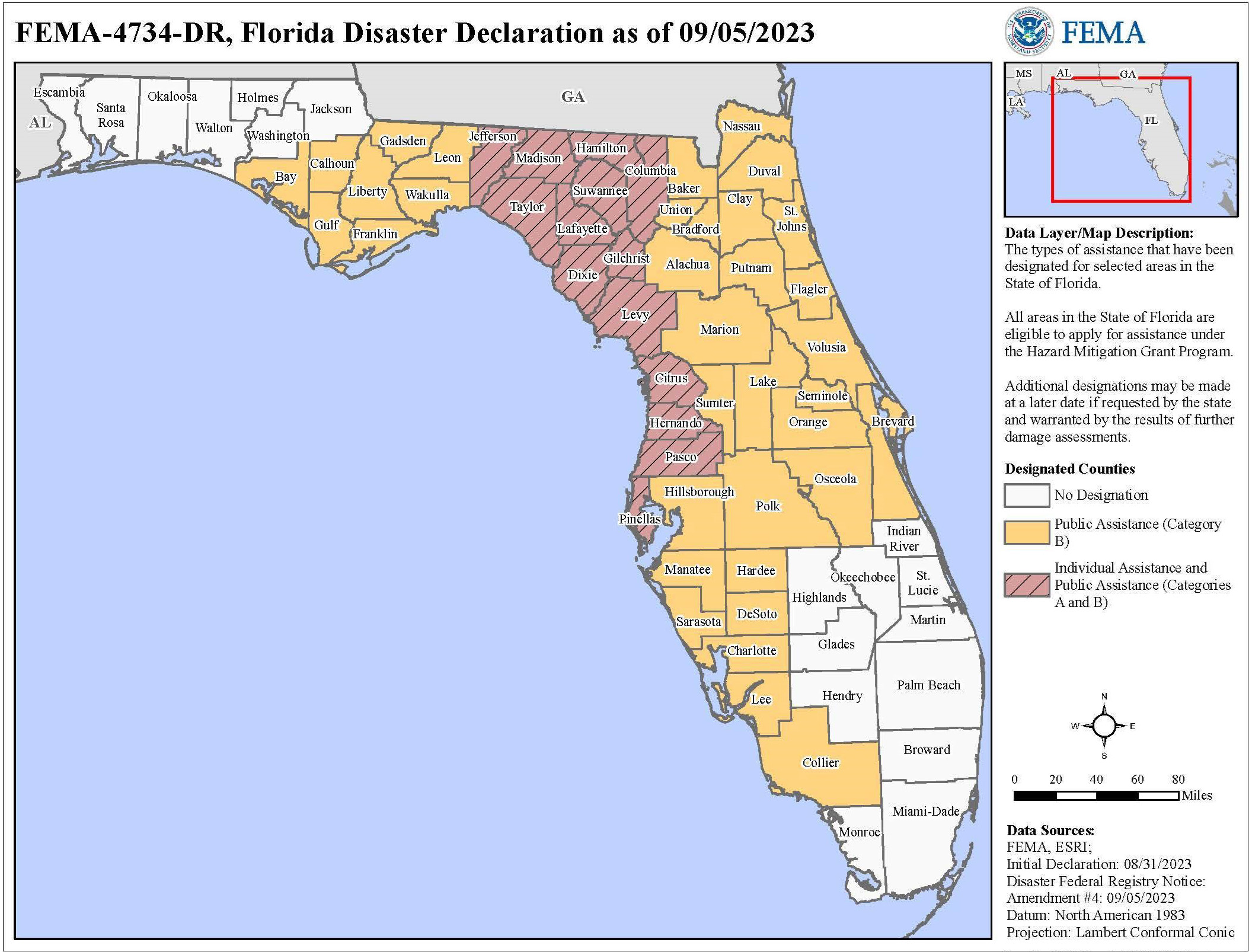

Per the notice: "Victims of these recent natural disasters will have until February 15, 2024, to file FBARs for the 2022 calendar year. As set out in the notice, FinCEN is offering this expanded relief to any area designated by the Federal Emergency Management Agency (FEMA) as qualifying for individual assistance, and for additional counties the Internal Revenue Service provided expanded tax relief for."

The FinCEN notice currently names Alachua, Baker, Bay, Bradford, Calhoun, Charlotte, Citrus, Clay, Collier, Columbia, DeSoto, Dixie, Duval, Flagler, Franklin, Gadsden, Gilchrist, Gulf, Hamilton, Hardee, Hernando, Hillsborough, Jefferson, Lafayette, Lake, Lee, Leon, Levy, Liberty, Madison, Manatee, Marion, Nassau, Pasco, Pinellas, Polk, Putnam, Sarasota, Seminole, St. Johns, Sumter, Suwannee, Taylor, Union, Volusia and Wakulla as counties receiving relief.

This current list omits three counties - Brevard, Orange and Osceola - which were later added to the IRS' list of those receiving relief. As we did with the IRS, we have asked FinCEN for clarification on the three counties listed above.

The notice granting relief comes following a request made by the FICPA to FinCEN last week.

DOR Grants Corporate Tax Relief to Impacted Counties

On Friday, the Florida Department of Revenue (DOR) announced it has suspended corporate income tax due dates and extension periods for certain taxpayers affected by Hurricane Idalia in parts of Florida until March 1, 2024.

The counties currently included are:

- Alachua, Baker, Bay, Bradford, Brevard, Calhoun, Charlotte, Citrus, Clay, Collier, Columbia, DeSoto, Dixie, Duval, Flagler, Franklin, Gadsden, Gilchrist, Gulf, Hamilton, Hardee, Hernando, Hillsborough, Jefferson, Lafayette, Lake, Lee, Leon, Levy, Liberty, Madison, Manatee, Marion, Nassau, Orange, Osceola, Pasco, Pinellas, Polk, Putnam, Sarasota, Seminole, St. Johns, Sumter, Suwannee, Taylor, Union, Volusia, and Wakulla counties.

The FICPA submitted a formal request to DOR last week asking for relief from the Department in the aftermath of Hurricane Idalia.

IRS Expands Relief in Response to FICPA Request

The IRS on Wednesday announced that it has added Brevard, Orange and Osceola to the list of Idalia-impacted counties being granted tax relief through Feb. 15.

These three counties were included in FEMA's Florida Disaster Declaration on Aug. 30 but were not included in the IRS' original list of counties being granted extensions.

This IRS update comes in response to a letter sent by the FICPA last week, in which we alerted the IRS to the discrepancy and requested that it update its communications to include Brevard, Orange and Osceola, raising the total number of counties receiving relief to 49.

The latest FEMA map identifying counties eligible for individual and/or public assistance appears below.

The FICPA will continue to advocate on behalf of its members throughout hurricane season, representing the interests of CPAs and their clients.

Hurricane Idalia Recovery: DBPR Issues Emergency Orders

To facilitate Hurricane Idalia recovery efforts, the Florida Department of Business and Professional Regulation (DBPR) has issued these emergency orders. To view Executive and previous DBPR Emergency Orders, as well as additional resources related to hurricane states of emergency, visit DBPR’s website.

DBPR Emergency Order 2023-07 suspends certain provisions of section 489.113(3), Florida Statutes, in order to allow certified or registered general, building, or residential contractors to subcontract roofing work for the repair or installation of any roof type in listed counties.

DBPR Emergency Order 2023-06 extends multiple deadlines for license renewals and implements these provisions, among others:

- Community Association Management Firms: The existing license renewal deadline of September 30, 2023, as established by section 468.432(2)(d), Florida Statutes, is suspended and tolled through October 25, 2023, unless extended by subsequent order, for Community Association Management Firms. Licenses renewed on or before October 25,2023 shall be considered as timely renewals and will not be assessed any late fees.

- Condominiums, Timeshares and Mobile Homes: The annual $4 fee per mobile home, as established by section 723.007(1), Florida Statutes, and the $1 surcharge, as established by section 723.007(2), Florida Statutes, are suspended and tolled through October 25, 2023, unless extended by subsequent order. Payments remitted by October 25, 2023 shall be considered as timely renewals and will not be assessed any late penalties.

Gov. DeSantis Activates Florida Small Business Emergency Bridge Loan Program

Businesses in 25 Florida counties eligible to apply

On Sept. 1, Gov. Ron DeSantis activated the Florida Small Business Emergency Bridge Loan Program, making $20 million available for businesses impacted by Hurricane Idalia. Florida small business owners in need of assistance are encouraged to visit the Florida Commerce Rebuilding Florida Businesses website to apply for the Florida Small Business Emergency Bridge Loan Program. Businesses in the following counties, including sole proprietors, are eligible to apply:

Alachua, Baker, Bradford, Citrus, Columbia, Dixie, Franklin, Gilchrist, Hamilton, Hernando, Hillsborough, Jefferson, Lafayette, Leon, Levy, Madison, Manatee, Marion, Pasco, Pinellas, Sumter, Suwannee, Taylor, Union and Wakulla counties.

Governmental Affairs Team Preparing for Committee Weeks, 2024 Legislative Session

FICPA Chief External Affairs Officer Jason Harrell, along with contract lobbyists Liberty Partners of Tallahassee, is holding meetings with key legislative staff and stakeholders in preparation for the start of Interim Committee Weeks on Sept. 18.

Harrell has held introductory meetings with staff from the Florida Department of Business and Professional Regulation and Florida Department of Revenue to continue strengthening relationships that promote the needs of profession. The FICPA State Legislative Policy Committee met in Orlando in August to develop the FICPA’s 2024 Legislative and Regulatory Policies, and the first bills of the 2024 Session have been filed.

Governmental Affairs continues to monitor the implementation of several important bills from the 2023 Session, and as always, your FICPA Advocacy Team will review all 2024 bills for possible impacts to CPAs.

Here are key dates for the 2024 Legislative Session.

Interim Committee Weeks:

- Sept. 18-22 (House)

- Oct. 9-13 (Senate)

- Oct. 16-20

- Nov. 6-9

- Nov. 13-17

- Dec. 4-7

- Dec. 11-15

First day of 2024 Legislative Session:

Last day of 2024 Session:

FICPA Letter-Writing Campaign: Petition Congress to Delay BOI Filing Deadline

In conjunction with the AICPA and other state societies, the FICPA is asking members to write to their congressional representatives, advocating that the start date for the Beneficial Ownership Information (BOI) reporting be delayed. You can find more information, including talking points and draft letters, at the link below. We ask that you contact your representatives by Sept. 15.

We will alert you to any tax-relief information as soon as it is available.

Be Part of the FICPA’s Key Person Contact Program

To develop strong grassroots relationships with members of the Florida House, Senate and Cabinet, the FICPA Governmental Affairs Team has developed a Key Person Contact (KPC) Program. In this program, the “contacts” are FICPA members who have personal relationships with Florida legislators. These members act as liaisons between the FICPA and lawmakers, creating a line of communication to relay technical and general information about legislative issues.

Your Governmental Affairs Team needs up-to-date information on members' relationships with Florida legislators. To become part of the KPC Program, please complete and sign this form and email to [email protected].

The FICPA’s continued legislative success depends on you!

Contribute

The Florida CPA/PAC supports the politicians who stand up for CPAs. We back the candidates and incumbents who will ensure CPAs and their clients are included in the legislative process. It is your voluntary contributions that help protect the CPA license.

Donate Now

Please note: Contributions are strictly voluntary and are not deductible for federal tax purposes. The Florida CPA/PAC is an entity completely separate from the FICPA. The Florida CPA/PAC is supported solely by the voluntary contributions of members of the FICPA and others.